[

On-chain information exhibits that whale entities have bought roughly 5% of the provision of main stablecoins over the previous three weeks.

Whales have been swallowing the stablecoin provide lately

In response to information from on-chain analytics agency EmotionWhales have been accumulating stablecoin provide at a fast price lately. Whale right here refers to buyers holding no less than $5 million in cryptocurrencies.

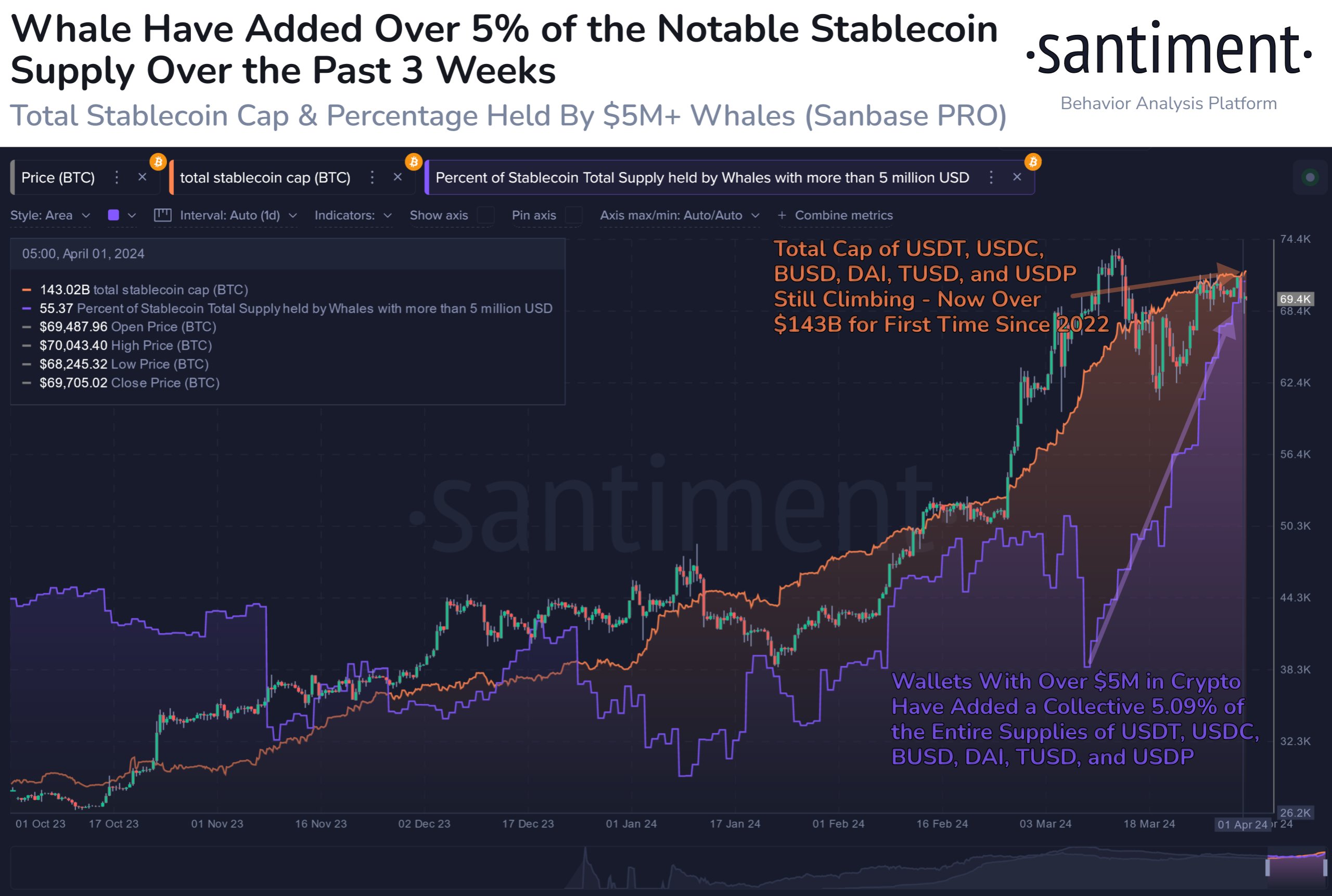

The chart under exhibits the development within the provide of main stablecoins held by these giant holders over the previous few months.

The worth of the metric seems to have been heading up in current weeks | Supply: Santiment on X

The “main” stablecoins right here embrace Tether (USDT), USD Coin (USDC), BUSD (BUSD), Dai (DAI), TrueUSD (TUSD), and Pax Greenback (USDP). The chart exhibits that the proportion of provide of those stables held by whale establishments has elevated lately.

This exhibits that these giant holders have accrued extra of those fiat-pegged tokens. In the identical chart, Santiment has additionally connected information for complete stablecoin market capitalization, and it seems that this metric has additionally been growing over the identical interval.

Nonetheless, the rise in whale holdings has been remarkably fast, that means newly minted tokens of those property won’t be the only supply behind the buildup.

General, whales have added greater than 5% of the mixed provide of those main stablecoins to their wallets over the previous three weeks, which is spectacular.

What does this accumulation from whales imply for the broader cryptocurrency sector? Basically, there are two causes for the rise within the share of whales.

First, there could also be some new massive cash coming into the market which can be selecting to enter via stablecoins. Second, whales are promoting cash from the unstable facet of the sector (like Bitcoin) to hunt security in these dollar-pegged cash.

The previous is all the time optimistic for the area, indicating an influx of latest capital. Nonetheless, the latter could also be bearish initially. Sometimes, nevertheless, buyers who select to put money into stablecoins accomplish that as a result of they plan to finally enter (or re-enter) the unstable facet.

Thus, the provision of stablecoins, particularly these held by whales, might be considered as capital sitting on the sidelines, ready to be deployed. As such, the current sharp enhance in whale holdings would imply that there’s at present a considerable amount of potential dry powder accrued for Bitcoin and others.

In a reply to a consumer underneath this X publish, Santiment additionally famous that Bitcoin accumulation from whales has been fairly robust lately. This suggests {that a} bullish mixture is growing because the surge in stablecoins was not merely as a result of whales shuffling capital from BTC to stablecoins however as a result of precise capital inflows.

btc worth

Not too long ago, there was an enormous fall in Bitcoin, as a result of which its worth reached the extent of $65,200.

Appears to be like like the value of the asset has gone via a pointy drop over the previous day | Supply: BTCUSD on TradingView

Featured picture by Rémi Boudousquié on Unsplash.com, Santiment.web, charts from tradingview.com