[

Under is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal's premium markets e-newsletter. To be one of many first to obtain these insights and different on-chain Bitcoin market evaluation straight to your inbox, Subscribe now.

With Bitcoin's subsequent halving happening this month, miners are utilizing document income to adapt their enterprise fashions to the chaotic event.

The cease is nearly upon us. As all the Bitcoin world waits with bated breath for the mining rewards halving, the prospect of latest income streams has us questioning how the sector will react to the brand new market situations. Halvings prior to now have typically been linked to Bitcoin's prosperity, however they’ve additionally been identified to shake up beforehand held beliefs on a big scale. We’re already seeing some examples of those market adjustments; To call only one, massive miners are modernizing their gear to make sure most environment friendly {hardware}. This has led to large gross sales of previous gear from these firms, sending hundreds of mining rigs to miners in Africa and Latin America. Ethiopia's low-cost hydropower is already attracting worldwide capital to what has turn into a brand new mining hub, and a big portion of those rigs are going there for pennies on the greenback.

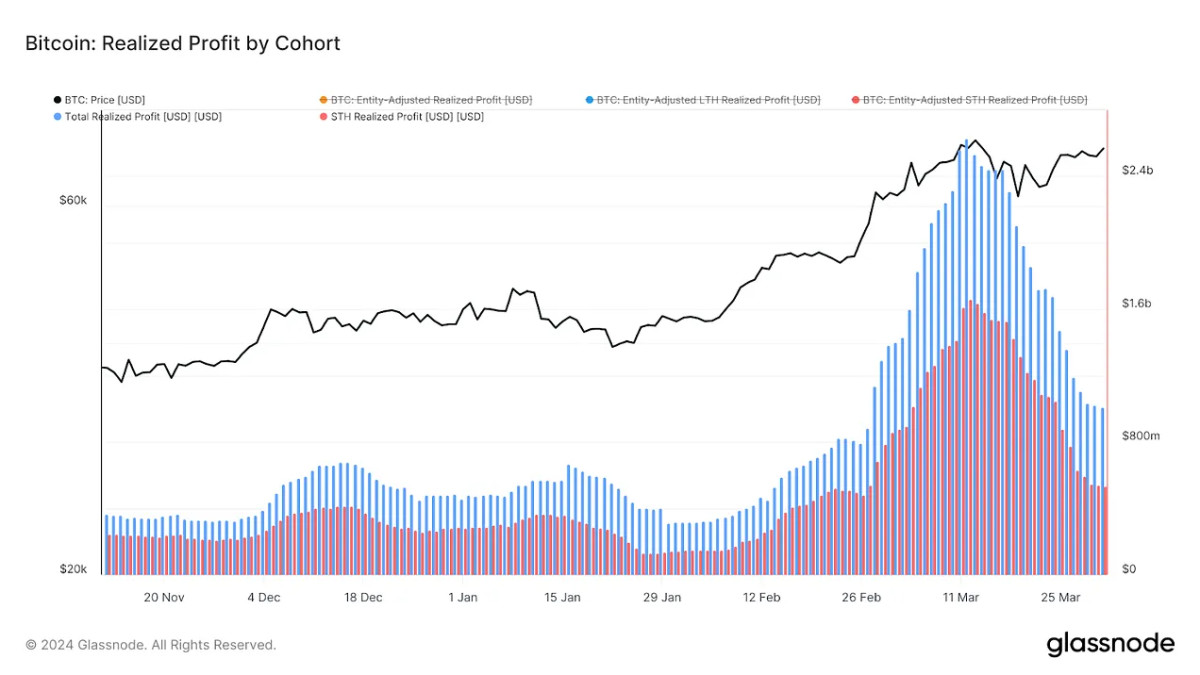

In different phrases, miners expect to see much less manufacturing within the close to future, however this has nonetheless inspired the creation of latest mining firms all over the world and web progress for the {industry}. This is only one instance of the surprising alternatives that can take the digital asset sector by storm, and it’s as much as Bitcoiners to grab them. For miners as a complete, alternatives are actually considerable. March 2024 noticed the very best month-to-month income ever for the mixture mining {industry}, exceeding $2 billion. That is notably notable as lower than half of this income got here from transaction charges, a far cry from the scenario in December the place transaction charges overtook mining rewards.

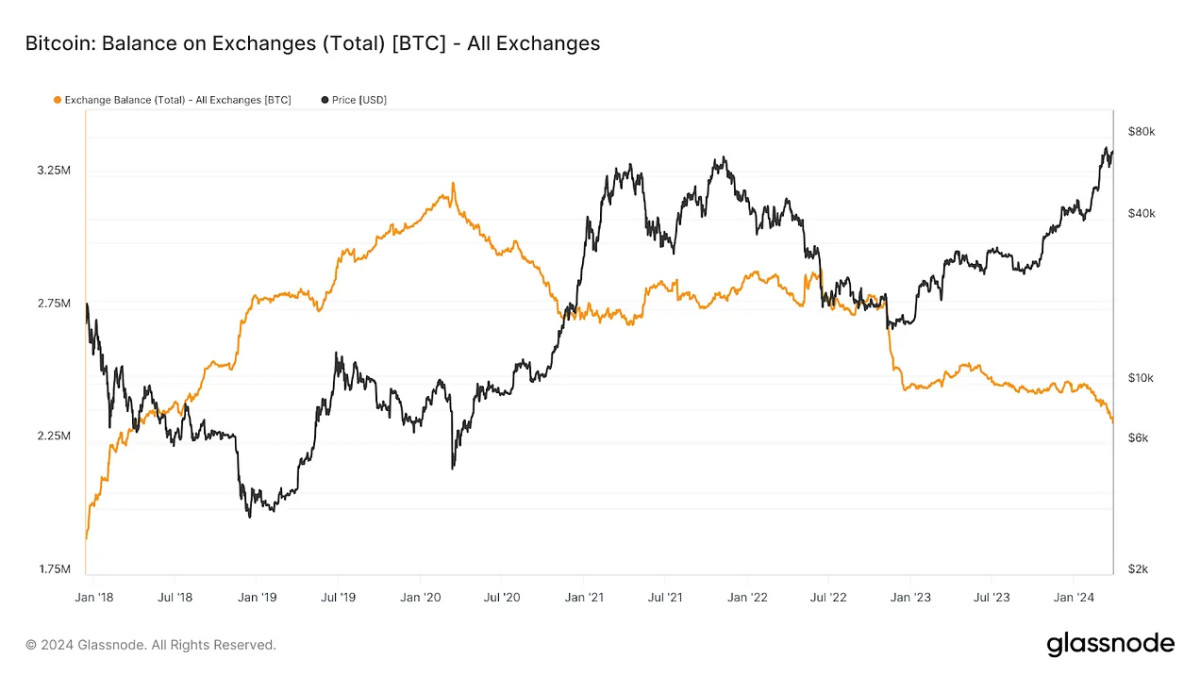

In December, the worth of Bitcoin was very low, and the blockchain suffered from congestion. This congestion not solely suppressed demand to purchase Bitcoin, but additionally elevated demand for miners to course of the blockchain. Resolving transactions on already mined Bitcoins generates a bigger share of income than mining and promoting new ones, and this enterprise has turn into a lifeline for a lot of small firms. Nevertheless, now it appears as if cash is flowing all over the place. Bitcoin ETFs are gobbling up Bitcoin at an exorbitant price – greater than 6 instances the precise output of miners. The bonus has additionally introduced enterprise capital curiosity again into focus, additional fueling the frenzy. Within the first three months of 2024, main exchanges collectively noticed their reserves of Bitcoin decline by practically $10 billion, indicating enormous demand for the newly minted cash. With market situations like these, it’s no shock that miners' income have reached all-time data.

Nevertheless, whereas this era of intense promoting has actually created a possibility for miners, there are additionally dangers related to the halving. These firms are in a blind race to safe as a lot income as potential earlier than the halving, and the race is so determined for a easy motive: trendlines might ship encouraging information, however there's no actual assure that Bitcoin's value will sustain with its provide. After shortening it should enhance accordingly. The hype halving and the immense success of the ETF have pushed the worth of Bitcoin to all-time highs, however this has been adopted by volatility. Bitcoin has been hovering round its nice benchmark since crossing it, nevertheless it has not been capable of proceed its bullish rise. If the worth of Bitcoin continues to behave unpredictably, it should ultimately wreak havoc on smaller firms and result in {industry} consolidation.

Moreover, a very fascinating growth has emerged within the secondary Bitcoin markets. As extreme demand from ETF issuers and different monetary establishments has utterly outstripped provide, some long-term holders (LTH) are waking as much as fears of a generalized liquidity crunch. The whales who had been beforehand content material to carry Bitcoin for a number of years have modified their conduct, apparently deciding that now could be the time to lastly make large income. In March 2024, long-term holders started promoting their property at unprecedented charges, making disproportionate quantities of revenue in comparison with different Bitcoin sellers. Clearly, this sort of useful resource can't final ceaselessly, nevertheless it's an vital reminder to some miners: simply since you're having bother making ends meet, doesn't imply the {industry} is doing the identical. . Adapt, in any other case house will discover new methods to depart you behind.

Nonetheless, miners massive and small haven’t accepted the problem of the halving. These wild income have enabled companies to spend money on a wide range of preparedness methods, generally even dramatically shaking up their enterprise fashions. For instance, American agency Arkon Power has beforehand operated as an infrastructure firm, seeing itself as a supplier to a buyer base of impartial miners. Because it introduced a serious buy of state-of-the-art mining gear on April 2, it joined the industry-wide pattern of getting ready to mine with most environment friendly machines. Nevertheless, somewhat than providing this gear to its earlier prospects, Arcane has said its intention to mine Bitcoins itself. This easy change represents a dramatic shift of their total enterprise mannequin, they usually plan to maneuver ahead with the “aim of creating Archon some of the environment friendly miners on the earth.”

Main miner Hut 8, alternatively, has begun a enterprise mannequin pivot of its personal, however in a barely totally different route. In a Q1 earnings name in late March, CEO Asher Genoot acknowledged that 70% of the corporate's income got here from asset mining, however anticipated there could be some change in plans because the halving approached. Like many different mining firms, Hut 8 remains to be centered on upgrading its {hardware} and exploiting power sources at new websites, however additionally it is investing in a brand new route. This new route is just not in a separate asset, as its mining operations deal with Bitcoin, however in creating high-performance computing and AI operations. Genut claimed that these new operations had been “sub-par at the moment… however we're enthusiastic about that enterprise as a result of we see it as the muse to have the ability to develop.” “You will note how we proceed to be artistic to maximise the worth of every machine,” he added, stressing the necessity to keep a eager and disciplined perspective in the direction of present mining operations.

These are among the totally different new methods that miners are adopting to anticipate the halving. Corporations have been getting ready for months, and there may be nonetheless time to make extra new plans. On the time of writing, the halving is lower than three weeks away, and the countdown to the occasion displays the optimistic and celebratory perspective of Bitcoiners all over the place. Regardless of when the long-awaited day lastly arrives, some constants appear fairly dependable. There might be enormous demand for the world’s main digital asset, and the Bitcoin neighborhood may have the identical modern spirit as ever. Whether or not Bitcoin jumps instantly or behaves unexpectedly, it’s sure that somebody will emerge an enormous winner. For us Bitcoiners, this implies there’s a lot to sit up for.