[

Top-of-the-line issues within the factors world is attempting to determine which bank card bonus class will get you essentially the most bang in your buck on a sure buy.

When eating at a resort, this may be particularly difficult – do you have to use a card that earns bonus factors on eating or resort purchases?

Let's take into account questions that may information you as to which card you must use when eating at a resort.

How does the restaurant code?

Bars and eating places in resorts may be difficult as a result of generally they’re coded as resort or journey procuring and generally as eating. For many issuers, if a restaurant or bar is situated inside one other enterprise, comparable to a resort, will probably be coded as a resort or journey procuring.

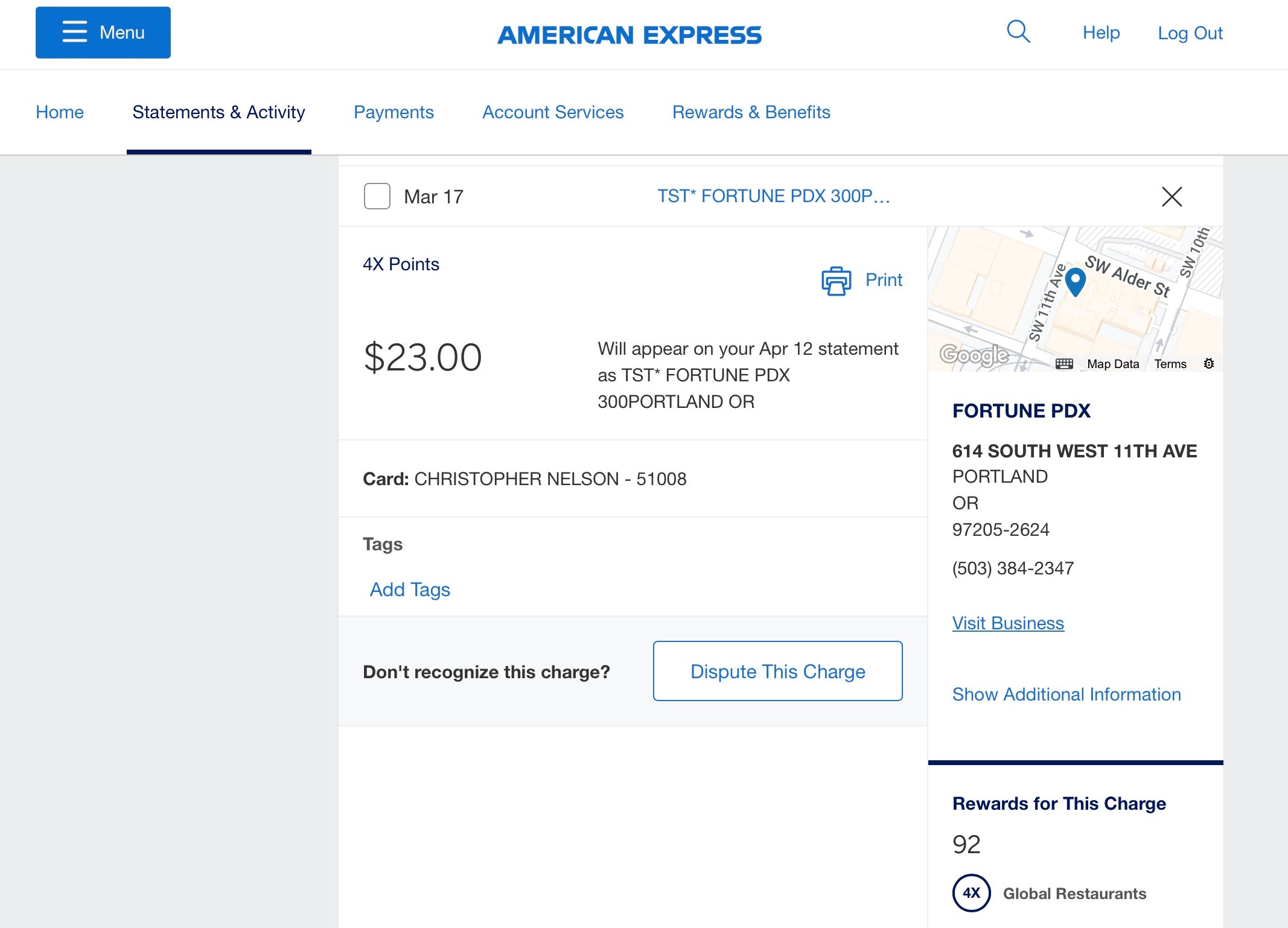

Nonetheless, I not too long ago went to a bar hooked up to a resort I used to be not staying at. i used mine American Categorical® Gold Card And it coded as a meal at a restaurant, so I earned 4 factors per greenback spent.

Due to this fact, every restaurant or bar related to a resort could also be given a special code on a case-by-case foundation. I've seen that if the restaurant or bar is a series, it’s coded as eating.

In case you're not sure how eating will code, a secure guess is to make use of a card that earns bonus factors on each eating and resort purchases, such because the Chase Sapphire Most popular® Card or the Chase Sapphire Reserve®.

Associated: Finest Credit score Playing cards for Meals

Are you staying in a resort?

In case you're staying at a resort and don't need to take any dangers on how the restaurant will code, your best choice is to cost in your meals in your room. Then, your restaurant or bar invoice might be added to your total resort invoice, making certain that will probably be coded as a resort expense.

each day newspaper

Reward your inbox with the TPG Every day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG's specialists

In case you have a card that earns bonus rewards on journey however not on eating, just like the Ink Enterprise Most popular® Credit score Card, this can be a great way to make sure you'll earn bonus rewards in your eating purchases.

And when you have the resort's co-branded bank card, you'll earn bonus factors on purchases and might even get further advantages like eating reductions. For instance, utilizing a Marriott cobranded card at Bonvoy properties can earn you as much as 23 level {dollars}.

Whereas it doesn't at all times make sense to spend on cobranded bank cards, the most effective causes to take action is to gather massive bonus multipliers on resort stays.

Associated: Select a Resort Credit score Card?

Ought to I take advantage of my eating card or my resort's cobranded bank card?

In case you have a card with nice incomes charges on eating, such because the Amex Gold Card, it could be tempting to make use of it to pay at your resort eating places and earn helpful transferable rewards as an alternative of resort factors. Nonetheless, most cobranded playing cards have excellent incomes charges for purchases at their resorts, so that you'll nearly at all times be forward of the curve by charging your in-room eating and paying along with your cobranded resort card each time attainable.

For instance, when you take the prospect that the restaurant will code as Eating and use your Amex Gold to pay your invoice, you'll earn 4 factors per greenback on that buy – in line with a TPG evaluation, 8% return. However when you take that chance and buy code at a resort as an alternative of a restaurant, you'll solely earn 1 level per greenback.

Nonetheless, when you cost your room invoice and pay along with your cobranded resort card, you'll make sure you get your card's bonus-earning resort charge for purchases.

RELATED: Marriott Bonvoy Boundless Credit score Card Overview: Value Holding 12 months After 12 months

Understanding Bonus Multiplier

In case you're an unique resort and are staying on the property the place you're eating (quite than simply coming in for drinks), you'll earn unique bonus factors in your whole folio along with the factors you get from bank card spending, you Providing you with much more motive to cost your meals invoice out of your room.

For Marriott, it’s damaged down as follows:

- common member: 10 factors per greenback

- silver: 11 factors per greenback

- Sleep: 12.5 factors per greenback

- platinum: 15 factors per greenback

- Titanium and Ambassador: 17.5 factors per greenback

And since most cobranded resort playing cards embrace a degree of elite standing, you're nearly at all times higher off charging your meals in your room and utilizing your resort card to repay all the folio on the finish of your keep. Is.

For instance, Marriott Bonvoy Sensible® American Categorical® Card Comes with automated Platinum elite standing. In case you cost in-room eating and pay in your keep along with your Sensible card, you'll get a complete of 21 factors per greenback – 15 in your particular standing and 6 factors when you pay along with your Sensible.

In accordance with our evaluation, these 21 factors per greenback equate to greater than a 17% return — which is greater than even the perfect eating card in your pockets.

The bonus multiplier construction is comparable for chains like IHG, Hilton, and Hyatt. The upper your standing, the extra bonus factors you earn.

RELATED: Evaluating the Finest Resort Elite Standing Tiers and Earn Them

floor degree

When eating at a resort the place you're not staying, your most secure choice is to make use of a card that earns bonus rewards on each eating and journey purchases, so regardless of the invoice code, you'll get a terrific incomes charge. Is obtainable. However when you're staying at a resort, you'll in all probability need to cost your room invoice and use a cobranded resort card or different card that earns bonus rewards on journey purchases.