[

An analyst has defined how the sample forming in Bitcoin Market Worth to Realized Worth (MVRV) might recommend now is perhaps the time to purchase.

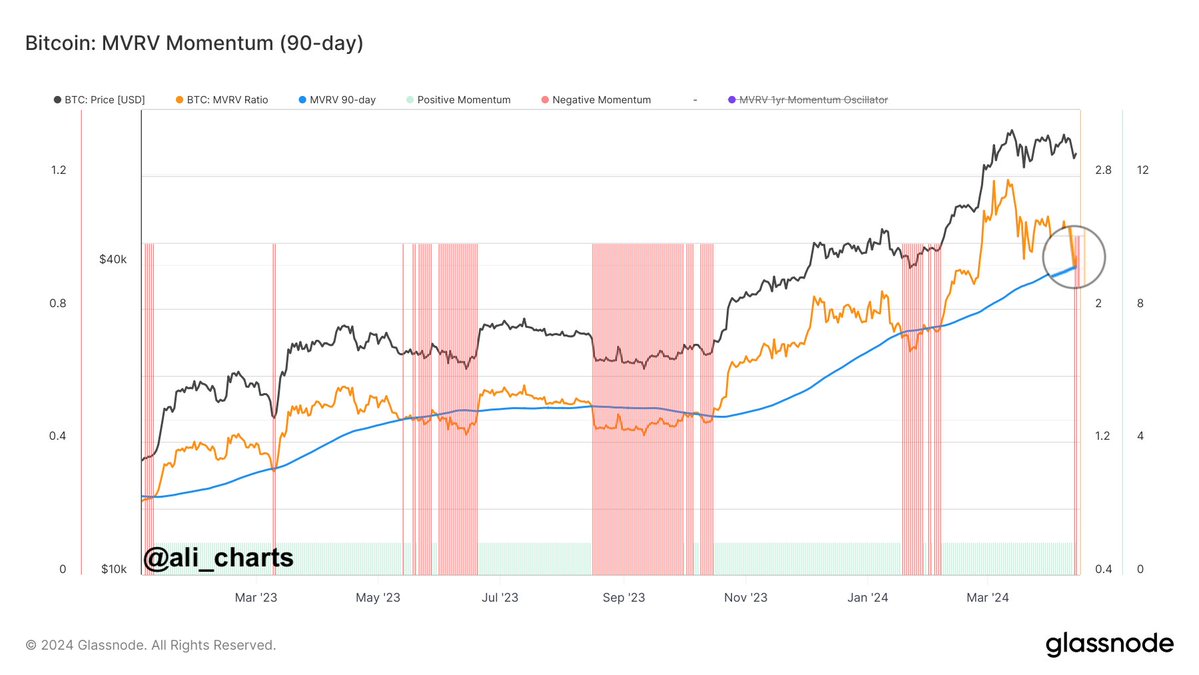

Bitcoin MVRV Momentum May Reveal a Shopping for Alternative for BTC

As analyst Ali explains it in a brand new approach Put up On X, MVRV momentum has been pointing in direction of shopping for alternatives for the cryptocurrency for the reason that present bull run started.

The MVRV ratio is a well-liked Bitcoin on-chain indicator that compares an asset's market cap to its precise cap. Actual restrict refers to a capitalization mannequin for the asset, which, in essence, retains observe of the particular capital utilized by holders to buy their cash.

Thus, a technique to take a look at the MVRV ratio is to check the worth that holders are carrying now (ie, market cap) with what they’ve invested within the asset (actual cap).

When the worth of the indicator is bigger than 1, the market cap is at the moment increased than the achieved cap. Such a development exhibits that the typical investor is making earnings. Then again, a metric falling under this vary means that the general market could also be thought-about underwater.

Naturally, the MVRV ratio being precisely equal to 1 represents the case the place traders have again precisely as a lot as they invested. That’s, they’re simply breaking even.

Within the context of the current matter, the MVRV ratio itself shouldn’t be of curiosity, however its comparability with the 90-day transferring common (MA) is attention-grabbing. The chart under exhibits the development in MVRV momentum for Bitcoin.

The 2 strains seem to have crossed in current days | Supply: @ali_charts on X

The graph exhibits that the Bitcoin MVRV ratio has declined lately. This decline is because of the falling worth of cryptocurrencies.

With this newest decline, the metric has slipped under its 90-day transferring common, which means there’s now detrimental momentum behind the indicator. For the reason that starting of this bullish development a 12 months and a half in the past, MVRV momentum has equally turned crimson on a number of events.

Because the graph exhibits, the assorted native bottoms in cryptocurrencies on this window usually coincide with the metrics taking these values. “When MVRV drops under the 90-day common, it alerts a shopping for alternative,” the analyst says.

Given this sample, the truth that Bitcoin MVRV momentum satisfies this situation once more might imply that now may very well be a super level of entry into the asset.

Nonetheless, the MVRV ratio slipping under the mark doesn’t imply that the decline ought to finish right here. BTC has usually fallen under this line, however at any time when it has slipped under it the underside has been shut.

btc worth

On the time of writing, Bitcoin is buying and selling at round $62,400, down greater than 11% up to now week.

The value of the asset seems to have witnessed some drawdown lately | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, Glassnode.com, Chart from tradingview.com