[

In terms of storing your bitcoin, multisignature—or multisig for brief—is widely known as one of the crucial safe strategies. It could possibly get rid of dangers related to exchanges and custodians, and concurrently addresses the commonest points with self-custody. On this article, we’re going to stroll by why you must maintain your individual bitcoin keys, what normal singlesignature self-custody appears like, and the way multisig is an enchancment for long-term chilly storage.

Why Ought to I Self-custody?

Curiosity in bitcoin normally begins with recognizing it in its place financial software that treatments a few of the clear risks of typical cash, similar to inflation, censorship, and confiscation. As motivation grows for transferring wealth into bitcoin, individuals are instantly confronted with the choice of the right way to safely retailer it.

The primary piece of recommendation you may hear is to keep away from custodial options. The explanation for that is easy: custodians of fiat currencies just like the U.S. greenback (banks, brokerages, and many others) can provide sure ensures that custodians of bitcoin can’t. For instance, authorities packages just like the FDIC and SIPC present insurance coverage for when a custodian loses shopper deposits, and this obligation can all the time be met. Bitcoin has a strict provide restrict—21 million cash—and new items can by no means be arbitrarily issued to switch cash which are misplaced by an irresponsible or malicious custodian.

Avoiding a custodian implies taking self-custody. On the planet of bitcoin, custody is set by who controls the non-public keys, as a result of the non-public keys are the instruments required to spend bitcoin. You probably have bought bitcoin on an alternate and haven’t withdrawn it to your individual custody managed by your individual keys, then the bitcoin stays managed by the alternate’s keys, and all you will have is an IOU, quite than precise bitcoin. As the favored saying goes, “not your keys, not your bitcoin.”

Holding your individual keys merely means defending secretive info, as a result of that’s what a non-public key’s: randomly generated information that must be saved non-public, and can’t realistically be guessed by anybody else. Producing a non-public key’s simple, and could be carried out on a laptop computer or a cellphone app, however it’s preferable to make use of a {hardware} pockets with the intention to trust your key was by no means uncovered to the web. Try a few of our different articles to be taught extra concerning the causes to make use of {hardware} wallets, and a few of the finest gadget fashions.

It’s fully regular to really feel apprehensive about holding your individual bitcoin keys. Individuals usually lose info similar to passwords, or bodily gadgets similar to sun shades and automobile keys. In case you are nervous that you simply may lose your bitcoin keys and subsequently additionally lose entry to your funds, that could be a legitimate concern! Nonetheless, multisig can assist you relaxation simple realizing that you’ve backup plans within the occasion that you simply make a mistake and lose some info.

First, what’s singlesig?

To know multisig, it’s essential to first perceive the predecessor technique of bitcoin storage: singlesig.

A singlesig pockets is the only and most generally used type of self-custody bitcoin pockets. It entails only one grasp non-public key, which may generate addresses for receiving bitcoin. If bitcoin is distributed to a kind of addresses, the quantity shall be counted in the direction of the pockets steadiness, and it could actually solely be faraway from the pockets after approval from somebody who has the non-public key.

The non-public key holder can show approval for a withdrawal through the use of the non-public key to cryptographically signal the transaction. You possibly can think about this like a bodily signature being utilized to a doc that specifies the transaction particulars, in a verifiably distinctive manner that may’t be solid. That is carried out inside your software program pockets, or for bitcoin in chilly storage, inside a {hardware} pockets. Then the signed transaction could be broadcast to the bitcoin community, the place it’s going to solely be acknowledged as legitimate if the proper signature was utilized.

Singlesig wallets take pleasure in being easy to arrange, in addition to offering pretty fast and quick access to withdrawing funds. Singlesig transaction charges also can price lower than multisig.

Nonetheless, a serious downside to singlesig is that it all the time entails a single level of failure. Particularly, there are two obtrusive points:

- Vulnerability to theft: In case your non-public key’s uncovered to another person, that individual could have what they should steal your bitcoin.

- Vulnerability to loss: When you lose your non-public key info (resulting from negligence or a pure catastrophe), you may lose the power to spend your bitcoin, that means you successfully not personal it.

Numerous mechanisms have been created in an try and mitigate these issues. Introducing instruments similar to BIP 39 passphrases or Seed XOR right into a singlesig setup can assist tackle the primary situation, however they arrive with the trade-off of exacerbating the second situation. One other software known as Shamir’s Secret Sharing can create an enchancment on each ends, however a single level of failure will nonetheless exist when it comes time to signal a transaction.

Because of this, many individuals flip to multisig because the gold normal for eradicating single factors of failure.

How is multisig totally different?

Whereas bitcoin secured by singlesig requires one signature from one particular non-public key to spend funds, that is only the start of what bitcoin makes potential. A multisignature bitcoin pockets, because the identify suggests, is a technique of securing bitcoin that may require signatures from a number of non-public keys with a purpose to spend the bitcoin. A subset of these keys are wanted to log off on spending any bitcoin that has been acquired into that association.

This construction is popularly described as an m-of-n quorum. The “m” represents the variety of non-public keys which are required to signal for a withdrawal to develop into legitimate, whereas the “n” represents the variety of non-public keys that exist which may produce one of many required signatures.

For instance, a 2-of-2 quorum signifies that there are two totally different non-public keys concerned, and signatures from each keys are required to withdraw bitcoin that was acquired into that association. This concept is perhaps acquainted to you in case you have ever used a security deposit field at a financial institution. Usually, these bins require two keys to be opened, one among which is held by you, and the opposite is held by the financial institution. There are additionally historic examples of comparable approaches.

Alternatively, you would create a 1-of-2 quorum, the place just one out of the 2 keys concerned is required to approve a spend. Or you would create a quorum that entails greater than two keys, similar to a 2-of-3. This could imply that three keys exist within the setup and any mixture of two of them can log off on spending bitcoin.

Multisig quorums are customizable to fulfill the wants of the person, so it may be prolonged to virtually any quorum you would think about—5-of-6, 2-of-9 or different complicated setups. Nonetheless, some quorums are dramatically extra common than others. 2-of-3 and 3-of-5 are by far probably the most extensively used preparations for securing bitcoin in chilly storage, for causes that we’ll cowl beneath.

The commonest bitcoin quorums: 2-of-3 and 3-of-5. Each strike a steadiness between complexity and safety.

Why use multisig?

Switching from singlesig to multisig means introducing extra keys, and subsequently extra complexity. Is it price it? Let’s check out a few of the benefits and drawbacks.

Upgraded safety

Earlier we mentioned a few of the largest issues that include utilizing singlesig. These included single factors of failure, similar to your non-public key being uncovered, misplaced, or destroyed. How can multisig assist?

With sure multisig quorums, redundancy is added to make sure that there is no one factor that, if it breaks or stops working, will trigger you to lose your cash. You possibly can relaxation simple realizing that if one among your non-public keys is uncovered to somebody, they won’t have all of the items wanted to steal your bitcoin. Moreover, if one among your keys is misplaced or destroyed, you may nonetheless get well your bitcoin through the use of the remaining keys in your possession to switch funds into a brand new pockets the place you as soon as once more have all of the items.

Nonetheless, not all multisig quorums provide these protections. A “1-of-n” quorum (similar to 1-of-2 or 1-of-5) doesn’t present ample resistance to theft, as a result of if any one of many keys is uncovered to somebody, that individual could have what they should steal bitcoin from you (they nonetheless want the related multisig file). Alternatively, an “n-of-n” quorum (similar to 2-of-2 or 5-of-5) would suggest that if any one of many a number of keys are misplaced or destroyed, you’ll not have the ability to spend your bitcoin.

Setups that slot in between these two extremes are the candy spot for addressing each classes of single factors of failure: loss and theft. The least complicated association that satisfies each targets is 2-of-3, which can also be the most well-liked multisig quorum for securing bitcoin in chilly storage, and the one one we use at Unchained. A 3-of-5 quorum is a reasonably common association as nicely, however it introduces extra complexity than vital for many conditions. Whereas 3-of-5 can present further redundancy, this level could be repeated to advocate for 4-of-7, after which 5-of-9, and so forth to infinity.

If you wish to get probably the most out of the protections provided by a multisig association, you must retailer all your totally different keys in geographically separated places, in order that no two keys could be misplaced or uncovered on the identical time. The easier your multisig setup is, the better it will likely be to create an efficient system for maintaining your keys safe and separated. You possibly can learn extra concerning the trade-offs between 2-of-3 and 3-of-5 in our deeper dive on the subject.

Further purposes

In addition to providing new custody choices for people, multisig can open the door for serving the wants of teams of individuals. By making a construction the place totally different folks maintain totally different keys throughout the multisig quorum, some engaging prospects develop into obtainable. Let’s briefly cowl a pair examples.

Treasury administration

If a enterprise, authorities or different group needs to carry bitcoin intelligently, multisig is all however required. Not solely due to the elevated safety, but additionally to make sure that the folks throughout the group have the suitable degree of energy to spend funds on behalf of the group.

Suppose a committee or legislative council consists of 9 folks, and this group shall be answerable for managing a bitcoin treasury. If every member of the group secures a non-public key, they will customise their construction so {that a} specific threshold of members should log off on a treasury withdrawal. Spending funds might require a small portion of the group (3-of-9), or a majority (5-of-9), or perhaps a supermajority (6-of-9).

Particular members of a gaggle like this might additionally possess extra energy to spend funds, in the event that they maintain extra keys throughout the chosen quorum.

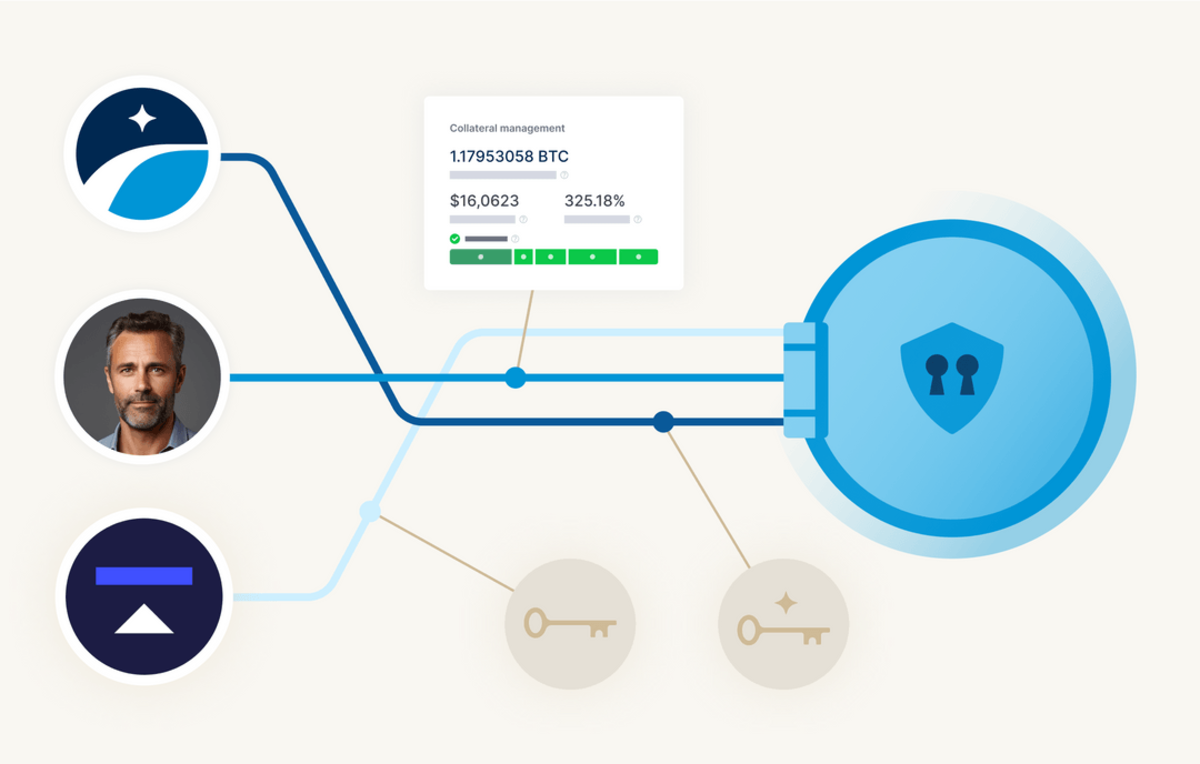

Belief-minimized collateral

Many bitcoin holders wish to train the buying energy of their bitcoin with out promoting it, which might lead to capital positive aspects taxes in addition to lacking out on future will increase in worth.

A preferred answer to this dilemma is a bitcoin-backed mortgage, normally constructed with a 2-of-3 multisig quorum. A bitcoin holder can borrow money from a lender after depositing their bitcoin into the multisig pockets, the place the borrower retains one key, the lender holds one key, a 3rd get together arbitrator holds one key, and two keys are required to withdraw bitcoin from the pockets.

As soon as the mortgage is repaid, the borrower and lender can use their keys to log off on returning the bitcoin to the borrower’s full management. If the mortgage just isn’t repaid, the bitcoin could be transferred to the lender’s full management. If there’s a dispute, or both participant is noncooperative, the arbitrator can evaluate the scenario and help the justified get together.

With this mannequin, stealing funds must contain collusion between two key holders, destroying the reputations of each entities. This construction is known as “trust-minimized,” a considerable enchancment over placing full belief in a single custodian. It additionally ensures that the bitcoin just isn’t being rehypothecated and stays obtainable to be moved into the complete custody of the rightful proprietor at any time.

Bitcoin-backed loans are a service provided by Unchained, and you may study specifics right here.

Commerce-offs with multisig

As famous earlier, there are a few trade-offs when utilizing multisig in comparison with singlesig.

First is the plain enhance in complexity that comes with incorporating extra keys into the custody association. With extra keys, there are extra gadgets to maintain observe of, and every merchandise will ideally be saved in separate places. It will make it extra cumbersome to withdraw bitcoin out of the pockets, which is sweet for stopping unauthorized entry, however could cause annoyance once you your self want to maneuver funds.

One other draw back is elevated transaction charges. When you obtain bitcoin right into a multisig pockets, once you later go to spend that bitcoin, it’s going to sometimes price you greater than if it have been in a singlesig pockets. This specifics rely upon a number of different elements, however on common you may be paying extra in charges the extra complicated your quorum is. In different phrases, singlesig shall be cheaper than 2-of-3, and 2-of-3 shall be cheaper than 3-of-5.

On the brilliant aspect, bitcoin’s taproot improve in 2021 made it potential for multisig transactions to be indistinguishable from singlesig on the blockchain. This suggests that they might price the identical, and there can be no further charge burden for multisig quorums! Nonetheless, on the time of writing, this expertise has but to be extensively adopted.

A preferred technique to make the most of the safety advantages of multisig whereas decreasing its drawbacks is to carry some bitcoin inside each custody preparations. For instance, you would hold the overwhelming majority of your bitcoin in a chilly storage multisig pockets for the aim of long-term financial savings, and concurrently hold a a lot smaller quantity of bitcoin in a singlesig scorching pockets in your cellphone. That manner, you would relaxation comfortably realizing the majority of your bitcoin wealth has most safety, whereas on the identical time you may simply ship and obtain smaller quantities in a extra handy method.

Easy methods to use multisig

Most individuals who arrange multisig for the primary time are stunned at how simple and easy the method is, particularly if they’re already acquainted with utilizing singlesig. That stated, there are nonetheless a few strategies price evaluating earlier than you dive in.

DIY (do it your self)

Free and open supply packages exist that will help you arrange a multisig pockets all by yourself. Examples of such packages embrace Caravan, Sparrow Pockets, Electrum, and Specter. There are video tutorials on YouTube if you need some help studying the right way to use these packages.

Since most bitcoin pockets expertise is constructed to be interoperable, for those who use one among these packages to arrange your multisig pockets, you must also have the ability to load that very same pockets into one of many different packages (so long as you will have your pockets configuration file saved). This offers some peace of thoughts that if one thing goes improper with software program you’re utilizing, your bitcoin continues to be protected and accessible.

Making a DIY multisig pockets could be a rewarding academic expertise, and it may also be a very non-public technique of getting arrange. Nonetheless, for those who run into any technical difficulties down the highway, it might be a headache to seek out somebody reliable who can assist you out. Equally, if one thing tragic occurs to you, your family members could possibly be tasked with determining the complexities of your multisig association with a purpose to inherit your bitcoin, which they may discover fairly difficult.

Collaborative custody

Whereas trusting a single custodian along with your bitcoin has been proven to be harmful, collaborative custody multisig is totally different. When carried out correctly, you may preserve management over the keys to your bitcoin whereas having the additional advantage of consultants who can help you with technical questions or inheritance.

For instance, with an Unchained vault, a 2-of-3 multisig pockets is constructed the place you maintain two of the keys and Unchained holds just one key. Which means Unchained can by no means transfer your funds out of the vault with out your permission, as a result of we are able to solely present one signature whereas two signatures are required for any and all withdrawals.

Alternatively, because you maintain two of the keys, you may present the 2 signatures wanted for a withdrawal with out ever counting on Unchained’s key! What’s extra, signing and broadcasting a transaction is a permissionless exercise, so so long as you might be maintaining your keys protected and accessible, no one can ever stop you from shifting your bitcoin elsewhere. Much like a DIY multisig pockets, you would all the time load an Unchained vault into one other software program (utilizing the pockets configuration file) so that you aren’t pressured to depend on our web site or enterprise.

A collaborative custody vault could be precisely known as a type of self custody, as a result of you’re the just one who has full energy to spend the bitcoin in your vault. On the identical time, Unchained’s key can come to the rescue for those who lose one among your keys, or it may be used to assist streamline the method of passing down your bitcoin in accordance with our Inheritance Protocol.

Utilizing collaborative custody just isn’t completely non-public, as a result of your collaborative associate may have workforce members with clearance to see your pockets steadiness whereas they’re aiding you with technical questions. Nonetheless, it is very important do not forget that Unchained takes shopper privateness extraordinarily critically, and it’s inconceivable for Unchained to spend your funds or limit your entry to your funds.

In case you are curious about establishing an Unchained vault, we invite you to study our Concierge Onboarding bundle. You should have as a lot time as you want with one among our consultants personally guiding you thru each step, and ensuring all your questions are answered.

Initially printed on Unchained.com.

Unchained Capital is the official US Collaborative Custody associate of Bitcoin Journal and an integral sponsor of associated content material printed by Bitcoin Journal. For extra info on providers provided, custody merchandise, and the connection between Unchained and Bitcoin Journal, please go to our web site.