[

Take into account a doomsday state of affairs. You've spent the previous few years diligently averaging greenback prices and making withdrawals in your pockets. You have got lots of small UTXO1And Bitcoin transaction charges enhance a lot that your Bitcoin turns into mud2, You are actually unable to spend your Bitcoin. For some Bitcoin customers, this isn’t a doomsday state of affairs, it’s a actuality they’ve skilled over the previous 6 months.

We noticed enormous fluctuations in Bitcoin transaction charges within the type of ordinals throughout 20233 There was a flood of recent Bitcoin customers and with it a big enhance in demand for Blockspace. Regardless of the optimistic stress of Bitcoin Spot ETF approval, customers have confronted critical challenges from excessive transaction charges, particularly for customers who maintain small UTXOs. In some circumstances, UTXOs weren’t spendable, also referred to as turning into mud. The ache of this transaction charge has led many to ask the query, how do I do know if my UTXO is in danger? For this text, we’ll discover the purpose at which mud is created and attempt to assist create a minimal plan to scale back this danger.

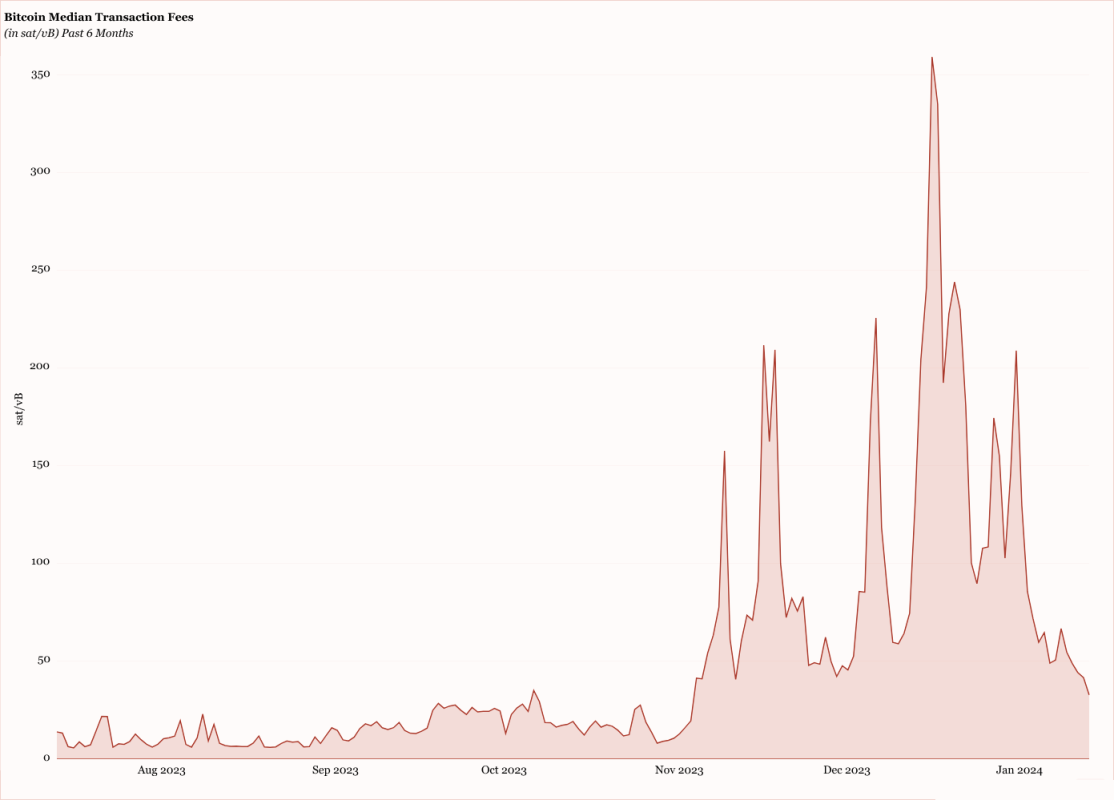

Bitcoin common transaction charge in sat/vB over the past 6 months

Over the previous 6 months now we have seen the typical Bitcoin transaction charge fluctuate wildly. We noticed Mempool clear with 0 SAT/VB and flying excessive at over 350 SAT/VB. Whereas at face worth this will likely not imply a lot to you, it might trigger main challenges for customers who’re sending many small worth SegWit UTXOs in a single transaction. Actually, some customers noticed their UTXOs turning into mud. This clearly precipitated panic and for some it turned out to be an costly lesson in UTXO administration. This isn’t an article that explains UTXO administration technique, this text makes an attempt to let you know that you simply positively need bigger UTXOs. If Bitcoin does what we expect it's going to do, many UTXO transactions as small as 0.001 BTC will not be spendable in a high-fee surroundings, and you’ll say goodbye.

Earlier than we get to the information, we have to outline what we need to see. For us we try to grasp whether or not the UTXO is spendable or whether or not it’s mud (non-spendable). For this we’ll want the next:

- The sum of UTXO is being despatched

- whole weight models4

- transaction charge sats/vB

From this info we are able to create a method that exhibits how a lot worth is transferred in a Bitcoin transaction after transaction charges are eliminated.

Worth transferred = BTC despatched – ((Whole Weight Models / 4) * Transaction Charge in SAT/VB) * 0.0000001)

If the worth transferred is a unfavorable quantity, it means you may have mud, it prices extra to ship a UTXO quantity than it’s price. As a result of calculating Bitcoin transaction weight models is a bit advanced, we’ll use a sensible state of affairs to make use of in establishing our desk, assumptions, and proposals.

For this instance we’re utilizing 5 fundamental SegWit (P2WPKH) monetary transactions with the next weight models:

- Single-input, single output, single signature, single pubkey, segwit transaction (P2WPKH script) whole weight models will probably be roughly 440 weight models.

- 5 inputs, single output, single signature, single pubkey segwit transaction (P2WPKH script) whole weight models will probably be roughly 1,528 weight models.

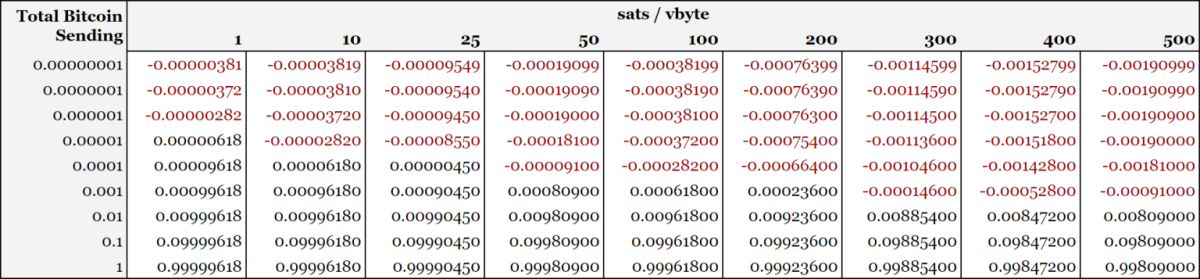

Utilizing our method above and SegWit transactions with (5) inputs weighing 1,528 weight models, we created the next mud desk.

mud desk

Mud desk calculated per 1,528 weight models5 The SegWit enter instance is given above.

The mud desk reveals some outstanding info. The mud is actual, and the brink is decrease than I imagined. As transaction charges proceed to rise, bigger worth UTXOs have gotten extra in danger. Throughout final month's peak transaction charge instances, our instance transaction would have yielded mud even for .001 BTC. That is barely lower than $50 as per present market circumstances. It feels unimaginable. 100,000 seats instantly turned to mud. Went. Unusable. That is horrifying.

Though this instance state of affairs doesn’t have an effect on all customers, the lesson could be very clear, create bigger UTXOs! You shouldn’t maintain UTXO smaller than 0.01 BTC for long-term storage. We noticed 300+ SAT/VB prices final 12 months and this can quickly turn into the norm. In that charge market, a number of UTXO transactions smaller than .001 are mud. Don't be that man.

Mud could also be an afterthought for you at the moment, we’re blessed with returns below 50 SAT/VB prices, but when not managed at the moment mud might turn into an costly downside for you sooner or later. By understanding the connection between UTXO weight models and transaction charges, we acquire useful perception into the dimensions of the decrease sure for UTXO.

peak of mud

Modeling the mud threshold for UTXO is an attention-grabbing experiment as a result of it exhibits you the way loopy issues get and at what level BTC turns into mud. For the desk beneath, we’re utilizing the identical information talked about above, which is 5 enter SegWit transactions with 1,528 weight models.

|

btc quantity |

mud threshold |

|

0.0000001 |

1 set/vb |

|

0.0000001 |

1 set/vb |

|

0.000001 |

1 set/vb |

|

0.00001 |

3 SAT/VB |

|

0.0001 |

27 SAT/VB |

|

0.001 |

262 sat/vb |

|

0.01 |

2,618 SAT/VB |

|

0.1 |

26,180 SAT/VB |

This desk exhibits the charge price at which the quantity of BTC despatched in a 1,528 weight unit transaction will flip into mud.

Signing a UTXO

One other necessary discovering in all this analysis is the price of signing single normal (P2PKH) UTXOs. That is excessive on the small facet because it is without doubt one of the smallest transactions you may make. For this instance we need to use normal script (non-Segwit) as it’s the heaviest of the script sorts. Listed below are the highlights:

- Normal (P2PKH) script sort

- 1 enter

- 1 pubki

- 0 output

- 632 weight models

signature on economics

|

obligation price |

signature price |

|

1 |

-0.00000158 |

|

10 |

-0.00001580 |

|

25 |

-0.00003950 |

|

50 |

-0.00007900 |

|

100 |

-0.00015800 |

|

200 |

-0.00031600 |

|

300 |

-0.00047400 |

|

400 |

-0.00063200 |

|

500 |

-0.00079000 |

Economics of signing a single normal UTXO with one signature, one pubkey and 0 outputs weighing 632 weight models.

With this info you possibly can perceive the minimal price of constructing a Bitcoin transaction.

key takeaways

- The mud restrict is decrease than you suppose, particularly in markets with excessive transaction charges

- When withdrawing BTC from exchanges take into account ready till your stability is ≥ 0.01 earlier than sending it to your storage.

- If in case you have many small (<0.001 BTC) UTXOs, you might need to consolidate them into a bigger UTXO when the charges go down.

You don't have a crystal ball, and there are lots of issues inside your management. BTC worth, blockspace demand, hashprice, hashrate, and Bitcoin generally are all out of your management. You have got management over your keys, and the perfect factor you are able to do is be ready for the inevitable excessive charge market. It would occur or Bitcoin will fail, I don't make the foundations. Don't let your valuable Bitcoins flip to mud. Bear in mind this, in case you do nothing you’ll return to mud.

By the sweat of your face you’ll eat bread till you come to the bottom, for from it you had been taken out; Since you are mud, and to mud you’ll return.

-Genesis 3:19

footnote

- UTXO (Unspent Transaction Output): (n.)

A part of a Bitcoin transaction that represents the quantity of the digital forex that has not but been spent and is offered for future transactions.

The output of a blockchain transaction that can be utilized as enter into new transactions represents the quantity of cryptocurrency remaining after the transaction has been executed. - Within the Bitcoin protocol, mud refers back to the small quantity of forex that’s lower than the charge required to spend it in a transaction. Though “economically irrational”, mud is often used to attain unconventional unwanted effects moderately than to alternate worth.

- Ordinals staking as a phenomenon is a bit of over a 12 months outdated now and has precipitated enormous waves in Bitcoin. They’re melting some folks's minds however finally their worth will probably be paid.

- Weight Models (n.) (Bitcoin)

A unit of measurement used within the Bitcoin community, particularly launched with the Segregated Witness (SegWit) protocol to calculate transaction and block sizes.

A composite measure that considers each non-witness information (similar to transaction inputs and outputs) and witness information (similar to signatures) of a transaction. On this system, non-witness information is given extra significance than witness information.

The usual by which block dimension limits are enforced within the SegWit protocol permits environment friendly and versatile allocation of block house, with a most restrict of 4,000,000 weight models per block. - Utilizing Lope's open supply transaction calculator. Hyperlink ↩︎