[

Bitcoin halving: gold is on borrowed time

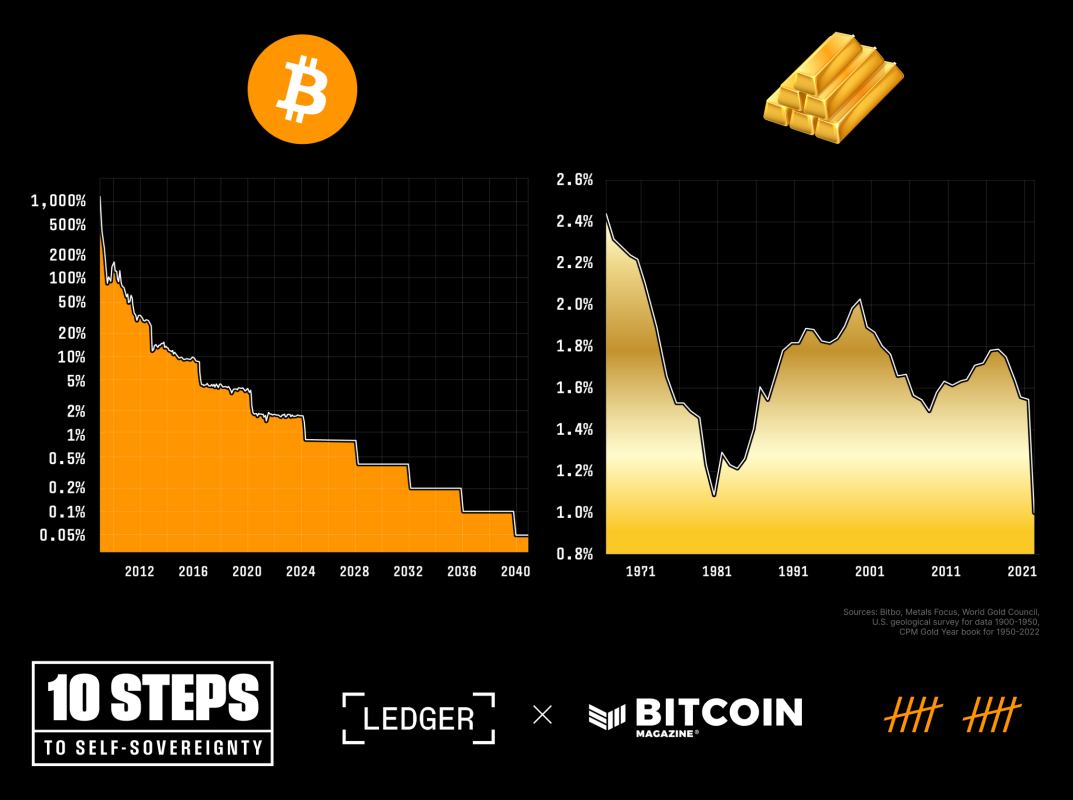

For the primary time since its inception, Bitcoin's annual inflation charge is poised to be decrease than that of gold, the quintessential retailer of worth. At Bitcoin block top 840,000, the annual provide of Bitcoin shall be halved, leading to its annual inflation charge reducing from 1.7% to 0.85%. Compared, the availability of gold is estimated to extend by 1-2% per 12 months relying on technological modifications and financial circumstances.

So far, Bitcoin has skilled three halving occasions:

November 28, 2012: Bitcoin's block subsidy decreased from 50 BTC per block to 25 BTC per block.

9 July 2016: The second Bitcoin halving decreased the block subsidy from 25 BTC per block to 12.5 BTC per block.

Could 20, 2020: The third Bitcoin halving decreased the block subsidy from 12.5 BTC per block to six.25 BTC per block.

The upcoming fourth Bitcoin halving is estimated to happen on April 20, 2024 EDT, and with it, newly provided Bitcoins per block will lower from 6.25 to three.125 BTC. This period – a interval of 210,000 blocks or roughly 4 years – will see the Bitcoin provide improve by 164,250 BTC (from 19,687,500 to twenty,671,875), which is simply 328,124 Bitcoins over the utmost provide restrict of 21 million.

~94% of complete #bitcoin Provides have now been launched and shall be halved in 11 days

Digital shortage at its peak 🚀 pic.twitter.com/fjbLs1tq7r– Bitcoin Journal (@BitcoinMagazine) 8 April 2024

gold for ages

A benchmark usually used to underline the store-of-value operate is that the worth of an oz of gold matches the value of a “good man's swimsuit” over time. This precept, often known as the “gold-to-civilized-suit ratio”, could be traced again to historic Rome, the place a top-of-the-line toga was valued on the equal of 1 ounce of gold. Used to go. After 2,000 years, the quantity of gold you’d pay for a high-quality swimsuit remains to be near the value of an equal historic Roman toga.

Whereas gold has lived as much as its holders' expectations of shopping for a nice man a swimsuit remarkably properly through the years, the shiny yellow steel comes with its personal challenges.

For instance, the price of verification – or assaying – requires the gold to be both dissolved in an answer or melted. That is definitely a problem for somebody who desires to buy on a regular basis home goods from their hard-to-price shops.

Moreover, the price and troublesome nature of transporting and storing gold led to the tip of the gold customary. Whereas certificates of deposit had been traditionally redeemable for gold, the underlying commodity was usually renegotiated, ensuing within the notorious “Nixon Shock” in 1971, when the US deserted the gold customary endlessly.

This isn’t to say the dangers that come from protecting bodily gold in safekeeping, its bodily nature once more proving danger and legal responsibility in fulfilling its operate as forex. Govt Order 6102 involves thoughts, when then-President Franklin Delano Roosevelt prohibited the “hoarding of gold cash”, highlighting the distinctive problem of adequately and privately securing valuable metals for worth storage. Was.

Bitcoin's transition from speculative to secure haven?

Initially thought to be a speculative asset as a consequence of notable worth fluctuations in its early days, Bitcoin has been more and more adopted as a retailer of worth. Right now, buyers acknowledge its potential worth and superior qualities as a financial asset. Bitcoin represents the invention of digital shortage whereas providing use instances far past valuable metals.

As such, Bitcoin has grow to be a big drive within the economic system in simply 15 years – reaching a market capitalization of $1.4 trillion on March 13, 2024.

Though this progress can’t be attributed partly to the truth that Bitcoin meets the necessities of a retailer of worth higher than gold, it’s definitely promising. This “magical web cash” is quickly gaining floor on gold’s estimated $15.9 trillion market capitalization.

Financial Properties of Gold: Digitally Perfected

Shortage: Bitcoin has a restricted provide of 21 million cash, making it resistant to the arbitrary inflation and market-driven provide of valuable metals that plague conventional currencies.

Sturdiness: Bitcoin is a totally data-based, immutable type of cash. Its digital ledger system makes use of proof of labor and financial incentives to withstand any makes an attempt to change it, making certain that it stays a dependable retailer of worth over time barring sudden catastrophic tail dangers. Given its informational nature, the power to retailer Bitcoin regardless of makes an attempt by adversaries to stop you from doing so is one other constructive financial attribute.

Irreversibility: As soon as a transaction is confirmed and recorded on the Bitcoin blockchain, it’s extremely troublesome, although not not possible, to alter or reverse. This immutability is a crucial characteristic derived from the geographic distribution of Bitcoin's community of nodes and miners. This ensures that the integrity of the ledger is maintained, and transactions can’t be tampered with or fraudulently dedicated. That is particularly necessary in an more and more digital world, the place belief and safety are paramount issues.

conclusion

The rise of Bitcoin as a financial commodity – predictable, free from terminal inflation, and simply transferable – has contributed to it gaining acceptance as a retailer of worth amongst holders. With the upcoming halving, its shortfall will exceed that of gold for the primary time and can seemingly function a warning to market contributors trying to keep away from the strain of financial easing.

Whereas there aren’t any certainties in life, and particularly not in investing, the close to certainty that Bitcoin supplies in its potential to keep up the integrity of its 21 million provide restrict by means of its decentralized nature is at one time Retains inspiring to undertake a block in.

There was a superb rise in gold. However, with the halving on the horizon, it’s Bitcoin's time to shine.