[

Under is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal's premium markets publication. To be one of many first to obtain these insights and different on-chain Bitcoin market evaluation straight to your inbox, Subscribe now.

New laws from the British Monetary Conduct Authority (FCA) have hit UK companies coping with Bitcoin and different cryptocurrencies, resulting in fast public disapproval.

These new guidelines, quietly carried out in mid-February, got here as a shock to most of the customers affected. The FCA has already hit a number of fee processors like PayPal and Luno, shutting down all skills for customers to purchase Bitcoin. Nonetheless, the principle focus of those new guidelines has been on creating what the FCA calls “constructive friction”. Constructing on earlier selections to counter the rise of “finfluencers” in 2023, akin to banning refer-a-friend bonuses and different incentives from non-crypto funding websites, the FCA goals its new guidelines at “funding To fight social and emotional strain. , Basically, the initiative was akin to one of the controversial laws: quizzes and different eligibility checks on all main exchanges, stopping customers from accessing their very own funds.

The background to new guidelines of this scale is, surprisingly, fairly advanced. For starters, the FCA is a monetary regulator that exists on the behest of the British authorities, however is just not instantly regulated by it. Though the Treasury appoints this board, its every day operations are unbiased of direct oversight. For instance, the FCA's predecessor company, the Monetary Companies Authority (FSA), was established to cut back the follow of {industry} self-regulation within the finance sector, which is a legally acknowledged sort of commerce affiliation. Actually, CryptoUK, the self-regulatory commerce affiliation within the UK digital asset sector, spoke out instantly in opposition to these new laws.

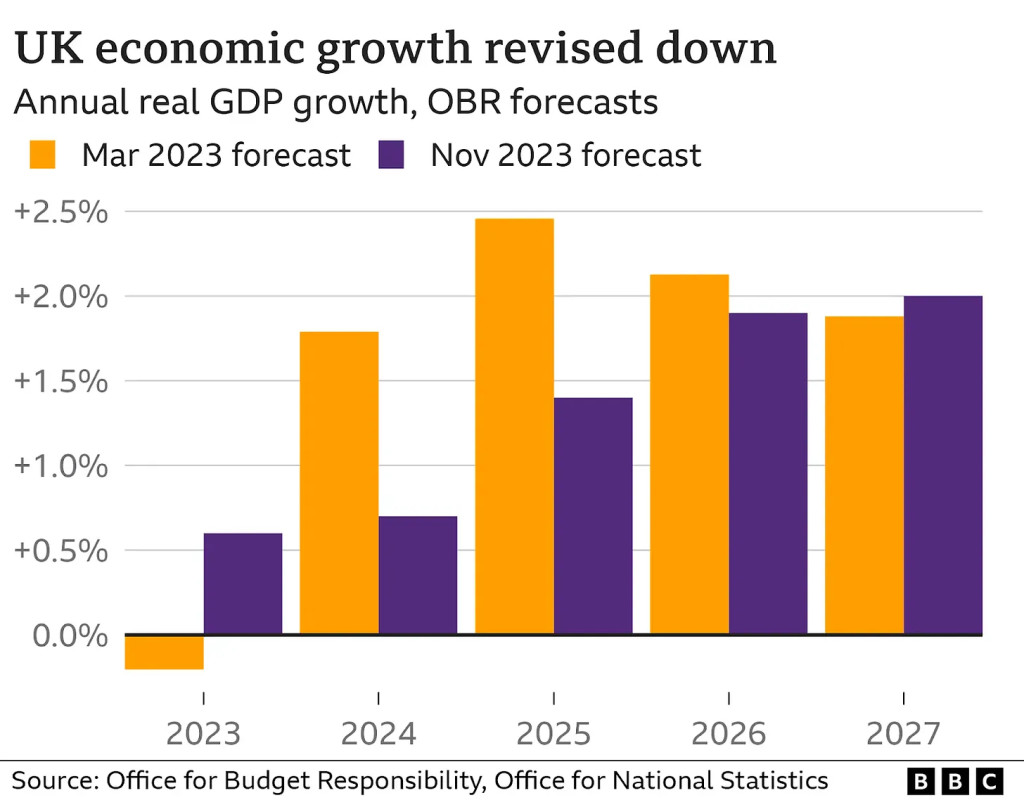

All that is to say, it’s no shock that the FCA feels empowered to take unilateral motion, particularly when it might run opposite to among the Parliament's long-term financial targets. British Prime Minister Rishi Sunak has laid out an bold coverage in an try to spice up development within the crypto sector. Sunak desires to make the nation a “crypto hub,” attracting worldwide capital and facilitating the expansion of the {industry} via pleasant regulation. It's no shock that Sunak has recognized Bitcoin as an space of main development: a big a part of the UK's present financial system is pushed by related long-term worldwide relationships on the planet of banking and finance, and expectations for the financial system proper now are excessive. are additionally lagging behind.

So, if those self same sources of earnings are failing to satisfy expectations, why not look to a fast-growing {industry} that may undoubtedly profit from these current relationships? Sunak claimed that the primary merchandise on his pro-Bitcoin agenda is to cross clear laws across the stablecoin, however new FCA laws are additionally excessive on his listing of priorities. Nicely then, there's only one query. Why did the agenda of putting the exchanges below “the identical authorized framework protecting funding banking and insurance coverage” result in a lot overreach?

For starters, the FCA has been marked for its infamous hostility in the direction of Bitcoin over the previous a number of months. Though the USA made headlines around the globe by approving a Bitcoin spot ETF, futures ETFs with extra oblique ties to Bitcoin's precise valuation have already been authorized earlier than then. Nonetheless, the FCA has fully shut down Bitcoin-related derivatives in 2021, and has given no indication that they intend to vary this stance. This backward angle places Britain behind not solely the US, but additionally its different largest buying and selling companions; Each main members of the English-speaking world akin to Canada and Australia, in addition to the European Union, have begun to embrace this billion-dollar derivatives market. Even Hong Kong, which has long-standing financial ties with Britain, has proven way more receptivity on this entrance.

Evidently, the FCA's conservative method to such a big and rising {industry} has hardly gone unnoticed. Lisa Cameron, MP and chair of the Crypto and Digital Belongings All-Celebration Parliamentary Group (APPG), has made public statements much like the studies revealed by the APPG, claiming that the world of Bitcoin is of great financial significance. Nonetheless, Cameron stated, “The APPG has made clear in its current investigative report that…we should be certain that the UK has sturdy requirements when it comes to regulation and client safety.” “The APPG is conscious that the brand new monetary incentive preparations have created problems for some crypto and digital companies, and studies recommend that many operators have paused crypto purchases whereas they adapt to the brand new preparations.” He additional added that “Whereas client safety have to be the highest precedence, the federal government and regulators should additionally take care to make sure that we don’t inadvertently deter accountable and controlled operators from investing within the UK”.

So, if nothing else, considerations about these laws are shared by precise legislators, not simply the group. Cameron's criticism appears notably notable as he has solely been a part of Sunak's celebration since October 2023, having beforehand received 3 elections below the SNP ticket. Moreover, Coinbase additionally made headlines in January by appointing former Chancellor of the Exchequer George Osborne to an advisory position. On condition that Coinbase is without doubt one of the exchanges most instantly affected by these new laws, a person who was in command of treasury for six years is certain to have helpful recommendation.

In different phrases, there are potential sources of opposition from many alternative sectors, as each customers in addition to authorities figures and {industry} leaders have expressed their objections. Nonetheless, so far as the timeframe for the FCA to vary its insurance policies is anxious, it’s anybody's guess. In the meantime, there have been a number of different main interactions between the British authorized system and the world of Bitcoin. Craig Wright, the so-called “pretend Satoshi”, is at present concerned in a court docket case over his continued claims that he’s the true inventor of Bitcoin. If the court docket guidelines in opposition to him, it might show to be the tip of a recurring episode within the Bitcoin subculture. Equally, though the USA is understood for essentially the most outstanding large-scale seizures of Bitcoin, British legislation enforcement managed to grab over £1.4 billion in Bitcoin in late January.

It’s probably that the FCA's guidelines will finally be loosened not directly, because the British authorities has prioritized making these new guidelines industry-friendly. If the pushback is vigorous and various sufficient, it can develop into clear {that a} new course is important. Bitcoin's financial star has been rising and rising over the previous few years, and it's too highly effective for unelected regulators to insist on a better stage. If we are able to see it in America's combat for a Bitcoin ETF, we are able to additionally see it within the FCA's response: nobody is robust sufficient to problem Bitcoin's crown.