[

Information reveals that whole open curiosity within the crypto sector has not too long ago been at an all-time excessive, indicating that volatility could also be coming for the cash.

Crypto open curiosity has been at excessive ranges not too long ago

As Martun, neighborhood supervisor at CryptoQuant Netherlands, defined in a Put up On X, whole crypto open curiosity has not too long ago been round $51.3 billion.

“Open Curiosity” right here refers back to the whole quantity of by-product positions associated to all digital belongings at present open on numerous exchanges within the sector.

When the worth of this metric will increase, it implies that buyers are opening new positions available in the market now. Sometimes, when such a development kinds the entire leverage within the sector will increase, so belongings could also be extra prone to see some volatility.

Alternatively, a decline within the indicator means buyers are closing their positions willingly or being liquidated forcibly by their platform.

There could also be some violent worth motion with sharp drops within the metric, however as soon as the worth of the indicator stabilizes, markets might grow to be extra secure as a result of discount in leverage.

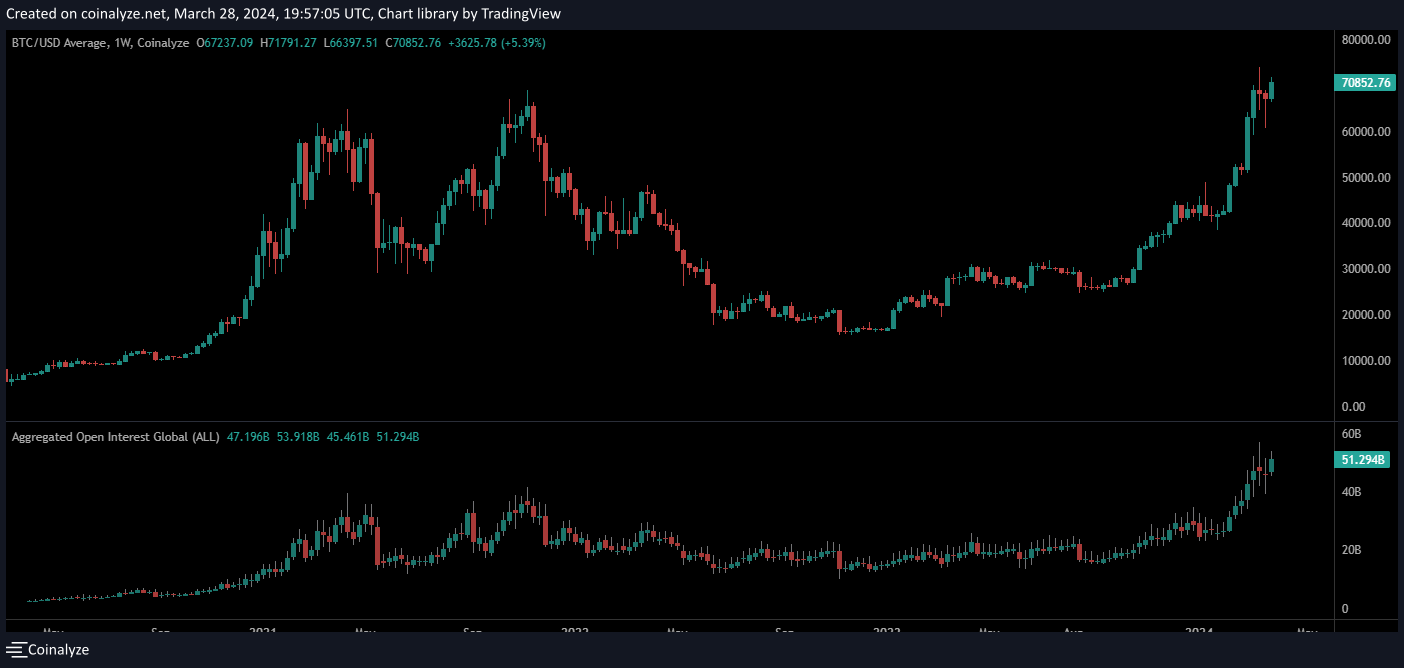

Now, here’s a chart that reveals the development of crypto open curiosity over the previous couple of years:

The worth of the metric seems to have been going up in current days | Supply: @JA_Maartun on X

As proven within the above graph, the entire open curiosity within the crypto sector has been on an uptrend not too long ago. This improve within the metric comes as the costs of Bitcoin and different belongings have gone via their rallies.

This isn’t uncommon, because the market attracts extra consideration throughout such worth motion. With giant quantities of consideration naturally comes hypothesis, so customers work together with posts throughout these durations.

From the chart, it’s seen that open curiosity within the crypto market additionally elevated in the course of the bullish interval in 2021. Nevertheless, the most recent values of the indicator have already surpassed the height seen at the moment.

The metric not too long ago hovered round $51.3 billion, an all-time excessive. As talked about earlier, excessive metric values can create volatility for numerous belongings within the sector.

As such, the present excessive ranges of open curiosity may imply that the market may even see some bullish worth motion within the close to future. This volatility can take the market in any path, a minimum of on paper.

As is evident from the graph, nevertheless, the indicator has traditionally solely seen a major decline at the side of a decline within the worth of Bitcoin, so the present exaggerated open curiosity might be a foul signal for the crypto market.

bitcoin worth

On the time of writing, Bitcoin is floating round $70,100, up 9% from final week.

Seems like the worth of the asset has gone stale not too long ago | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, chart from tradingview.com