[

On-chain information reveals that Bitcoin whales have participated in some giant distributions proper now, however the asset's worth has managed to carry on to this point.

Bitcoin Whales Are Promoting, However Sharks Are Increasing Holdings

In line with information from on-chain analytics agency Emotion, Massive BTC wallets are displaying an attention-grabbing sample proper now. The indicator of relevance right here is “Provide Distribution”, which tracks the whole quantity of Bitcoins presently held by totally different pockets teams.

Addresses are divided into these teams based mostly on the variety of tokens they’ve. For instance, the 1 to 10 cash group contains all wallets holding between 1 and 10 BTC.

Within the context of the current subject, two teams are of curiosity: sharks and whales. The previous traders are typically outlined as these with between 100 and 1,000 BTC, whereas the latter group contains these with 1,000 to 10,000 BTC.

Since there may be such a big steadiness between these two teams, their conduct could also be price following, as it might have an effect on the broader market. Whales are naturally the extra highly effective of the 2, as they maintain considerably bigger volumes.

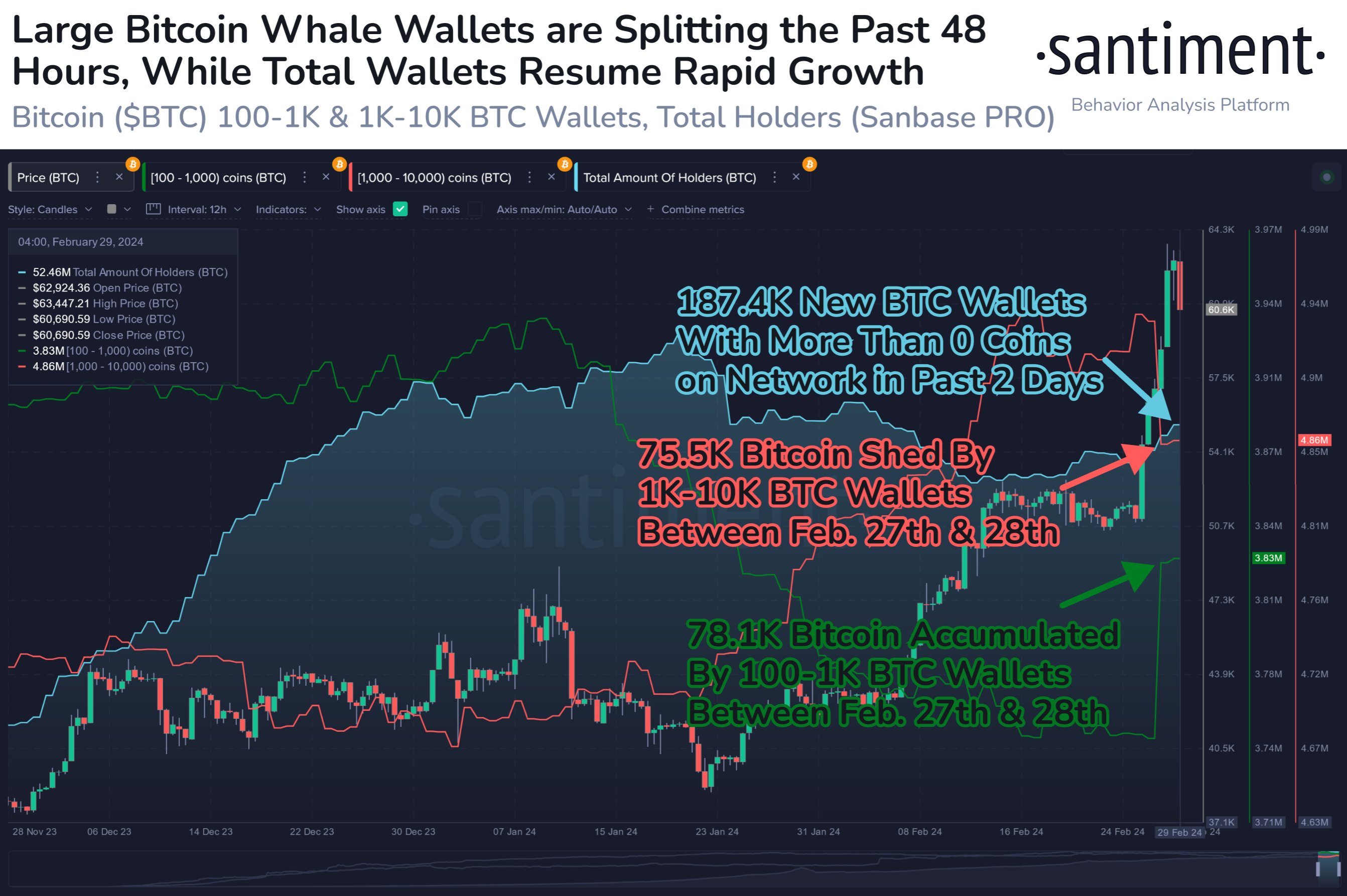

The chart beneath reveals the developments in Bitcoin provide distribution for these two giant investor teams over the previous few months:

Seems to be like the 2 metrics have gone reverse methods just lately | Supply: Santiment on X

As proven within the graph above, it seems that Bitcoin whales have misplaced a lot of cash from their holdings as a result of newest rally within the cryptocurrency's worth.

In whole, these large establishments have distributed roughly 75,500 BTC. Whereas whales seem to have participated on this sell-off, sharks have as an alternative seen a pointy enhance of their provide.

Throughout this accumulation spree, the group has raised 78,100 BTC. The attention-grabbing factor is that the quantity the whales bought is sort of the identical quantity because the sharks purchased. This might be brought on by considered one of two issues.

The primary risk is that the sharks merely bought these tokens from the whales' fingers. The second, and maybe extra attention-grabbing, state of affairs is that the “selloff” is just not truly a selloff, however relatively the results of whales breaking out their wallets.

Such redistribution of holdings amongst many small wallets might naturally create the type of impact seen out there proper now. And given the symmetry, in reality, this can be a probable risk.

Now, why would whales be exhibiting this conduct? As Santiment identified in its reply to a consumer asking the identical query, whales could also be shifting smaller stakes into and out of exchanges, or they could merely be taking security precautions.

Provided that the value of Bitcoin faltered after this development was fashioned, some promoting should still have occurred, however it seems that the market is just not having an excessive amount of bother absorbing this promoting stress to this point, as The value of BTC has remained comparatively managed as effectively.

btc worth

Bitcoin fell to a low of $60,000 not way back, but it surely appears to be like just like the coin has already bounced again as it’s now again at $62,400.

The value of the coin has loved a pointy rally over the previous few days | Supply: BTCUSD on TradingView

Featured picture by Mike Doherty on Unsplash.com, Santiment.internet, charts from tradingview.com