[

Trammell Enterprise Companions (TVP), based mostly in Austin, Texas, has unveiled its second annual findings from its in-depth analysis into the rising Bitcoin-native startup and enterprise capital ecosystem.

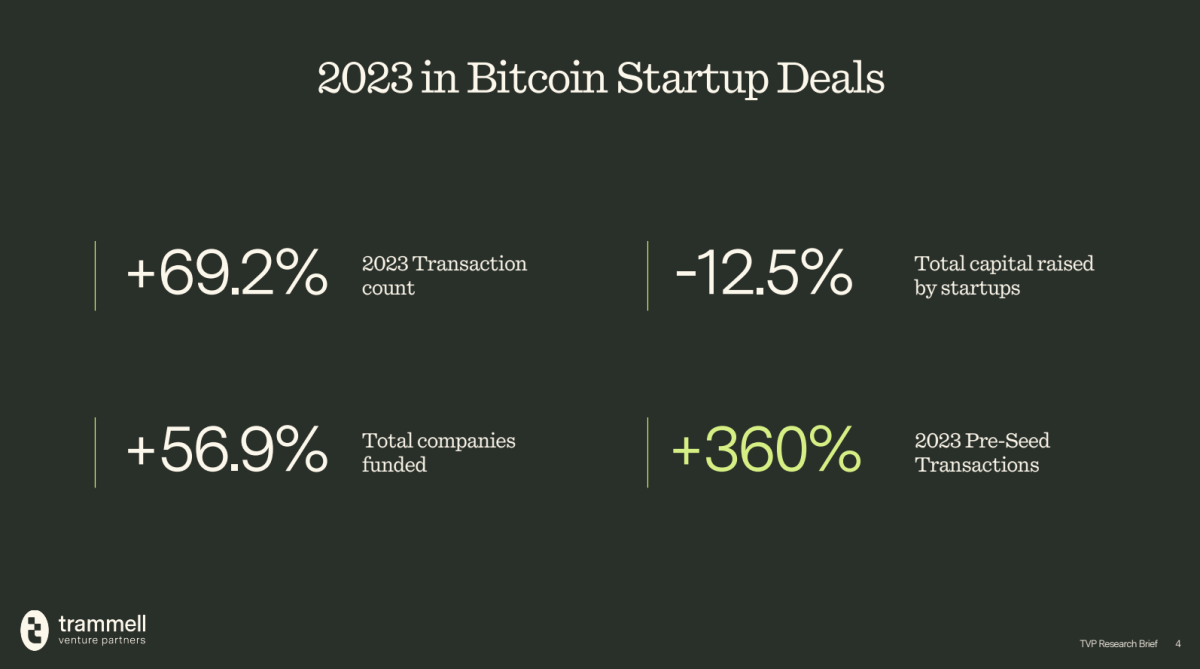

Regardless of a major decline in crypto enterprise market funding all through 2023, TVP's analysis highlights exceptional progress within the Bitcoin startup sector, significantly within the pre-seed stage, with a notable enhance of 360% year-on-year in transaction numbers. with.

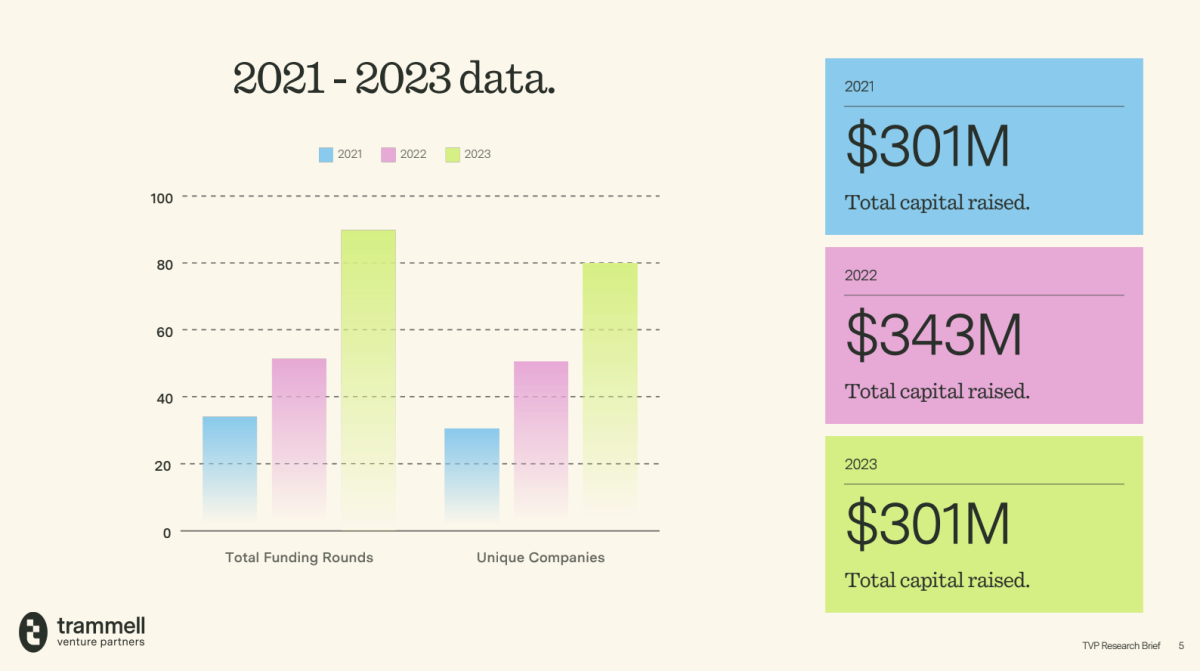

In distinction to the broader startup panorama that skilled a decline in exit exercise to a 10-year low in 2023, Bitcoin-native startups confirmed resilience and progress, displaying progress of 69.2% year-on-year. Knowledge from TVP revealed that these early-stage Bitcoin startups have collectively raised almost $1 billion between 2021 and 2023, indicating substantial curiosity and funding within the sector.

Christopher Callicott, managing director and founding companion of TVP, commented on the findings, which confirmed a powerful need amongst founders to construct on Bitcoin. He highlighted the rising help infrastructure and technological developments which might be fueling innovation inside the Bitcoin ecosystem.

“Early indicators from TVP analysis are according to our expectations for the tip state of the ‘crypto’ enterprise: Founders actually need to construct completely on Bitcoin,” Callicott mentioned. “With a quickly rising array of technological enablements selling elevated scalability and buildability on Bitcoin, this long-held TVP speculation is turning into an proof and data-supported actuality.”

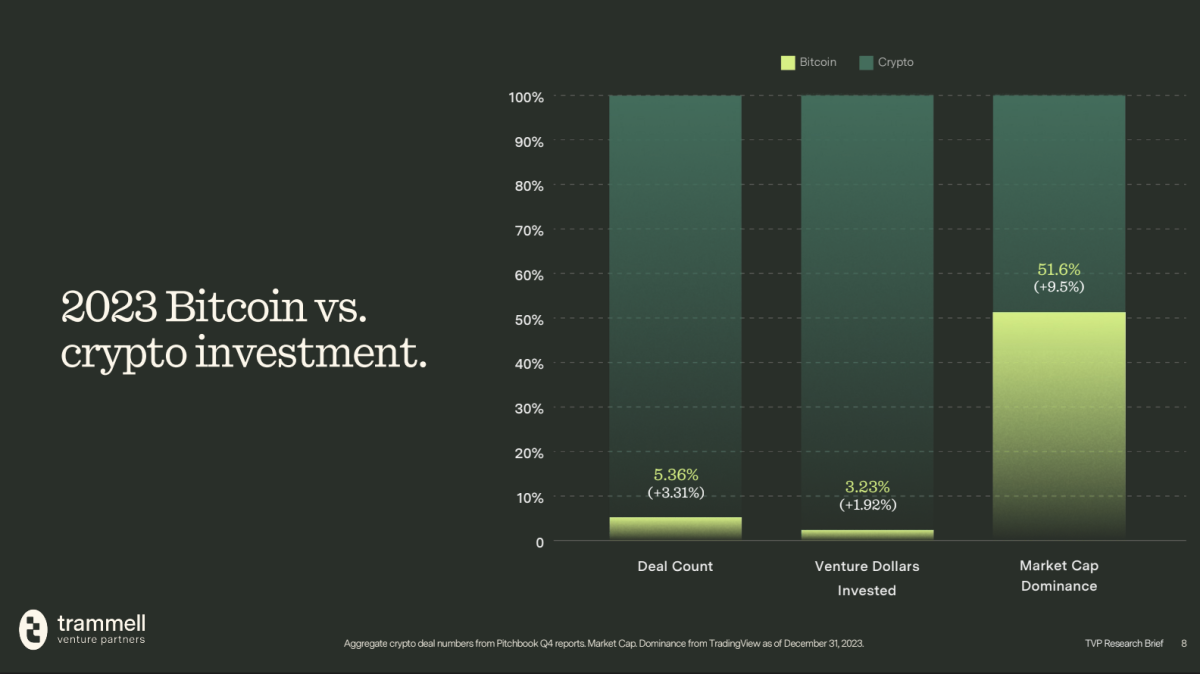

In 2023, the variety of Bitcoin-native enterprise offers elevated considerably, rising by 69.2%, whereas the variety of broader crypto enterprise offers decreased by 35.3%. Though Bitcoin-native enterprise offers are on the rise, crypto enterprise offers nonetheless account for the overwhelming majority of deal numbers and enterprise {dollars} invested.

“Because of the cyclicality and institutional embrace of Bitcoin, its market cap dominance is even increased than on the time of our 2023 report,” Callicott added. “Regardless of this, the allocation of Bitcoin-native enterprise capital is comparatively small. We consider the delta will start to shut as extra allocators start to see compounded income from the quickly rising design area on Bitcoin thanks to those early-stage Bitcoin startups.

TVP's dedication to fostering perception and analysis for the enterprise capital panorama led to the launch in 2021 of the trade's first devoted Bitcoin-native ecosystem-focused fund sequence. This annual launch of TVP's Rising Bitcoin-Native Enterprise Capital Panorama Analysis Transient goals to supply invaluable. Knowledge and help for institutional buyers in search of alternatives within the rising Bitcoin startup sector.

The complete TVP Bitcoin Startup Ecosystem Analysis Transient is obtainable for obtain, offering a complete overview of the evolving panorama and funding alternatives in Bitcoin-native applied sciences.