[

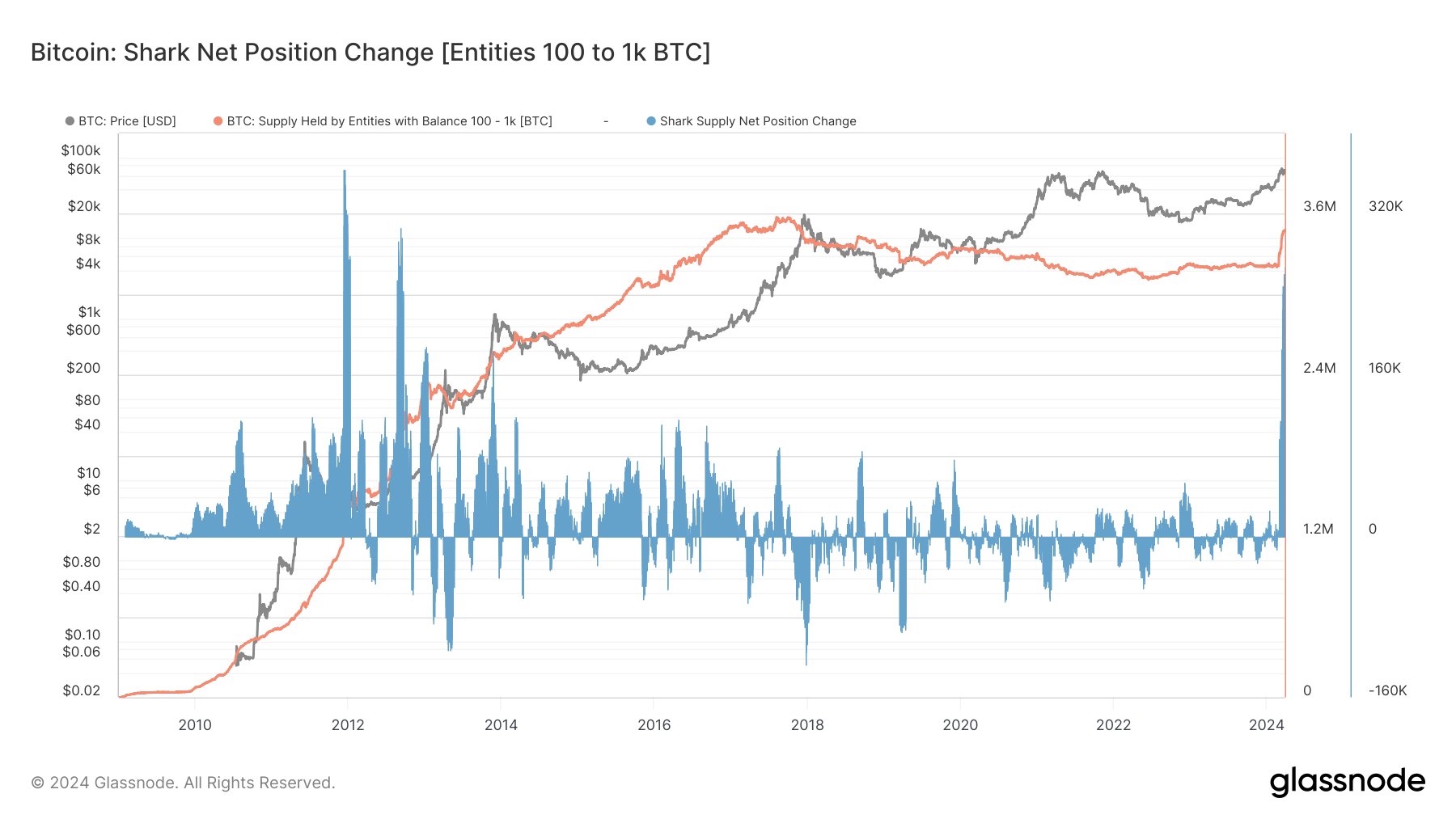

On-chain information reveals that the Bitcoin shark group has gone on its largest accumulation spree since 2012 over the previous month.

Bitcoin Sharks Have Purchased Over 268,000 BTC within the Final Month

As analyst James Van Straten explains in a brand new means Submit On X, Bitcoin establishments holding between 100 and 1,000 BTC have made some large internet shopping for strikes over the previous month.

An “entity” right here refers to a group of addresses owned by the identical investor, as decided by means of evaluation by on-chain analytics agency Glassnode.

Entities holding 100 to 1,000 BTC are popularly generally known as “shards”. On the asset's present change price, this vary turns into roughly $6.93 million to $69.3 million.

Thus, traders holding these quantities are clearly fairly giant, which implies they should have some significance to the market as a complete. Nonetheless, these sharks are nonetheless smaller and fewer spectacular than whales, which generally seize ranges above 1,000 BTC.

Given the relevance of sharks, their habits is of course price monitoring. One technique to observe this habits is thru the “internet state change” of the group.

This on-chain metric tracks the online quantity of provide getting into or exiting the wallets of entities belonging to the shard group over the previous month.

The chart beneath reveals the pattern of this indicator all through the historical past of the cryptocurrency.

The worth of the indicator seems to have been fairly excessive in latest days | Supply: @jvs_btc on X

Because the above graph reveals, the online place change of Bitcoin sharks has been at extraordinarily constructive ranges not too long ago. This might imply that these giant traders are including a internet variety of cash to their wallets.

Sharks have made a internet buy of roughly 268,441 BTC over the previous 30 days, at present price roughly $18.6 billion. This can be a staggering quantity and the biggest accumulation made by these holders since 2012.

On the time, the worth of BTC was a fraction of what it’s immediately, so the present shard accumulation can be probably the most spectacular within the asset's historical past primarily based on the quantity of capital concerned.

With such excessive ranges of accumulation, it’s no shock that the previous month has been a constructive one for Bitcoin, with its value reaching new all-time highs.

One other constructive improvement out there not too long ago is probably the outflows seen by cryptocurrency change Coinbase, as Stratton famous in one other X put up.

The pattern within the netflows for Coinbase over the previous yr | Supply: @jvs_btc on X

In line with the analyst, $1.1 billion price of property have been faraway from the platform's pockets yesterday, the third-largest internet outflow this yr, with the highest three all occurring throughout the final month.

Alternate outflows may very well be a bullish signal for cryptocurrencies, as they counsel traders are turning to self-custody, doubtlessly placing them to HODL on their cash for prolonged durations.

btc value

Bitcoin value has turn into a bit stale over the previous few days because it has been unable to decide on any course. At the moment, BTC is buying and selling at round $69,400.

Seems to be like the worth of the asset has been consolidating not too long ago | Supply: BTCUSD on TradingView

Featured picture by Marcelo Sidrac on Unsplash.com, Glassnode.com, charts from tradingview.com