[

In a unprecedented run, Bitcoin has managed to achieve $64,000, however is that this rally justified? Right here's what on-chain information suggests.

Bitcoin on-chain activity-related metrics obtainable now

in a brand new Publish On X, on-chain analytics agency Santiment mentioned what on-chain exercise is trying like for Bitcoin since its newest rally.

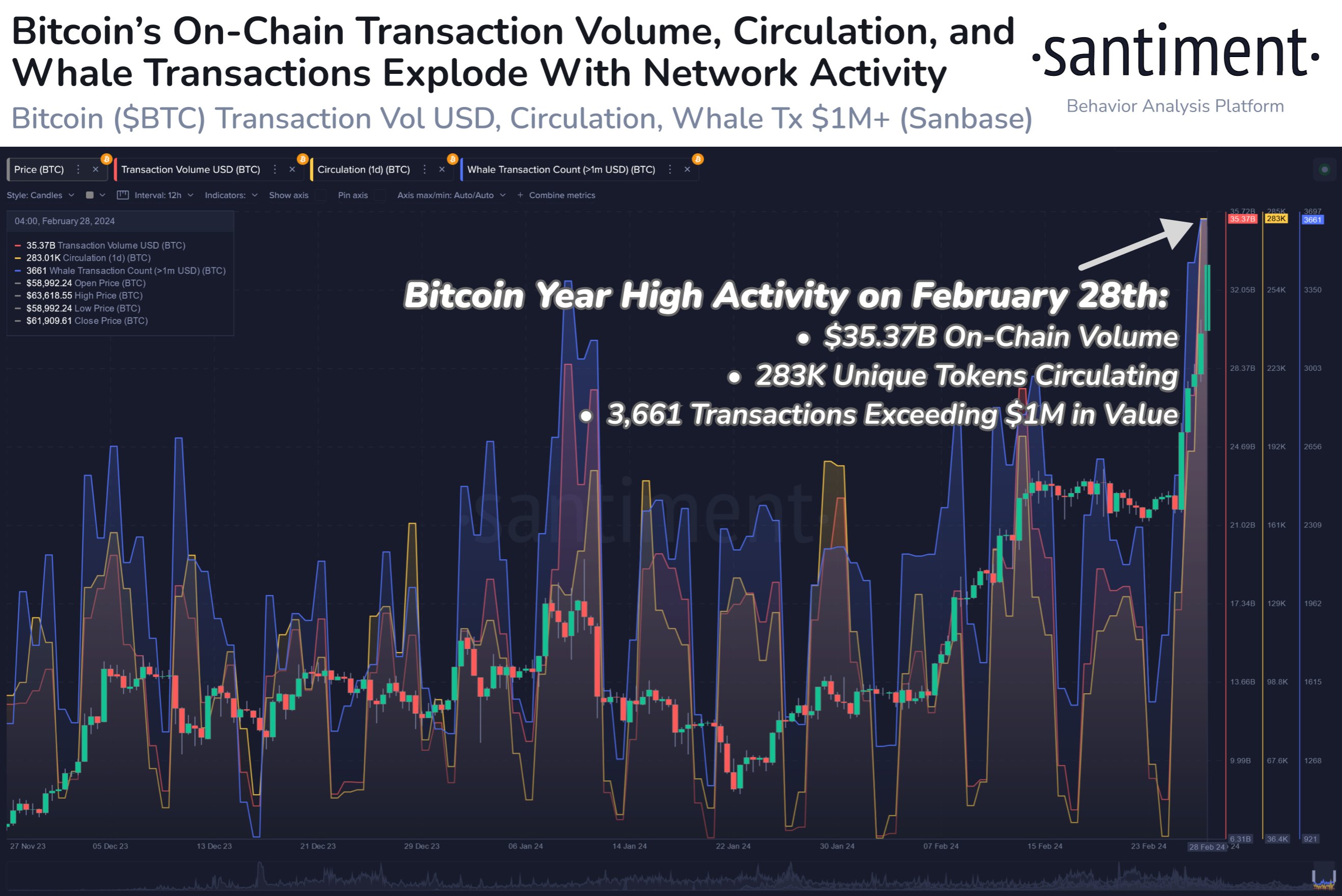

Beneath is a chart shared by the analytics agency that reveals tendencies occurring in three completely different BTC indicators: transaction quantity, circulation, and whale transaction rely.

All of those metrics seem to have seen a pointy rise in current days | Supply: Santiment on X

“Transaction quantity”, the primary metric of relevance right here, measures the whole quantity (in USD) of Bitcoins which might be becoming a member of transfers on the blockchain every day.

When the worth of this metric is excessive, it implies that curiosity within the asset amongst traders is excessive proper now, as they’re circulating in giant portions on the community.

Traditionally, sustained rallies are often accompanied by an rising development in quantity. Such intense value motion is of course engaging to traders, in order that they are usually extra lively in such intervals.

Extra lively individuals, in flip, assist present the gas for such a transfer ahead, so a rally actually wants to extend quantity whether it is to be sustainable.

Actions that begin rapidly however fail to draw adequate consideration can’t set up this suggestions loop and, subsequently, often finish a lot earlier.

From the chart, it’s seen that the transaction quantity has reached fairly excessive ranges together with this rally, which exhibits that consumer exercise is rising quickly.

The second metric of curiosity right here, “Circulation”, has additionally elevated together with volumes. This indicator tracks the variety of distinctive tokens concerned in transfers on the community.

This enhance within the indicator implies that the present excessive quantity will not be coming from artificially restricted parts of provide in repeated trades, however from natural strikes by distinctive traders.

Lastly, the “whale transaction rely,” which measures the variety of transfers price greater than $1 million on the blockchain, has additionally jumped with the rally, that means not solely small traders but in addition big whales are extremely lively. Have change into. ,

“Onchain exercise on crypto’s high networks has already surpassed ranges not matched since 2022, justifying Bitcoin’s historic excessive of $64K at the moment,” Santiment says.

The purpose to remember is that whereas excessive on-chain exercise means volatility ought to proceed, it’s not a certainty that it’ll solely be on the upside. Exercise can be increased throughout sell-offs, so if traders, particularly whales, swap to promoting, these metrics will nonetheless stay up.

btc value

Lately, the value of Bitcoin skilled sharp fluctuations and reached $64,000. Nevertheless, at present, the coin is buying and selling across the $62,700 stage.

Seems like the value of the asset has been sharply going up not too long ago | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, Sentiment.web, Chart from tradingview.com