[

On-chain knowledge exhibits that Bitcoin change flows have been low lately, an indication that whales usually are not interested by promoting.

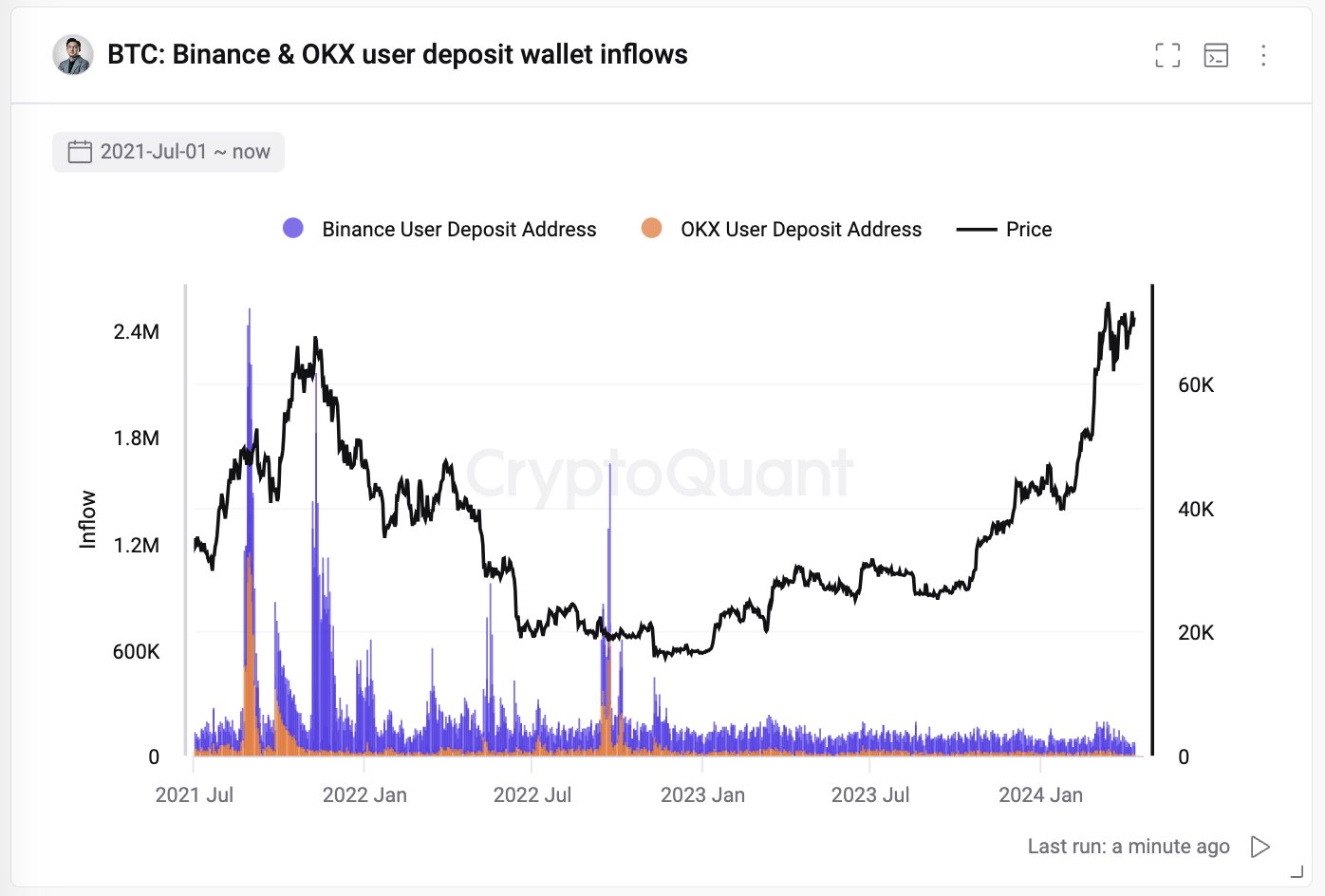

Bitcoin flows to Binance and OKEx have been low lately

As informed by Ki Younger Joo, Founder and CEO of CryptoQuant Publish On X, BTC deposits to cryptocurrency exchanges Binance and OKEx have been low lately.

The on-chain indicator of curiosity right here is “Change Influx”, which retains monitor of the whole quantity of Bitcoins which can be being transferred to wallets linked to centralized exchanges.

When the worth of this metric is excessive, it signifies that traders are accumulating numerous tokens on these platforms proper now. Since one of many predominant causes that holders will switch to exchanges is for selling-purposes, the sort of development can have a bearish impact on the asset.

Alternatively, decrease indicators imply that these platforms usually are not at present seeing as many deposits. Relying on the development of the alternative metric, change outflows, such a price could possibly be both bullish or impartial for the worth of the cryptocurrency.

Now, here’s a chart that exhibits the development in Bitcoin change flows for Binance and OKEx over the previous few years:

The worth of the metric seems to have been low in latest days | Supply: @ki_young_ju on X

Binance is the world's largest change by buying and selling quantity, whereas OKEx usually ranks second behind it in the identical metric. Whereas these two platforms are definitely not a proxy for the whole cryptocurrency market, consumer habits on them will present an concept of broader patterns.

Because the chart exhibits, change inflows for Binance and OKEx have been at comparatively low ranges for a while. When BTC noticed its rally in direction of a brand new all-time excessive (ATH) in the beginning of the yr, a slight enhance in deposits was seen, however lately, inflows have returned to decrease values.

This exhibits that the urge for food for promoting, particularly from whales, has not been there for the cryptocurrency. Even the ATH break may solely entice a few of the platform's greatest customers into promoting.

For instance, this habits is in distinction to the bullish second half of 2021, which might be seen within the chart. Not solely did the rally at the moment see some extraordinary movement development, however baseline flows had been additionally usually larger than latest ranges.

Curiously, the 2 main tops of the rally had been additionally fairly coincident with very giant inflows, so in line with this sample, the present rally might not be near the highest but.

Nonetheless, given the recent emergence of spot exchange-traded funds (ETFs), it stays to be seen whether or not the identical development will proceed on this cycle.

ETFs have offered another means for publicity to the asset, which means cryptocurrency exchanges can not maintain the identical relevance out there.

btc worth

On the time of writing, Bitcoin is floating round $70,400, up greater than 5% over the previous seven days.

Seems to be like the worth of the coin has principally moved sideways lately | Supply: BTCUSD on TradingView

Featured picture by Thomas Lipke on Unsplash.com, CryptoQuant.com, charts from Tradingview.com