[

Information reveals that Bitcoin Coinbase Premium has fallen into the purple zone, which can clarify why the asset's value has fallen beneath $68,000.

Bitcoin Coinbase Premium Index turns purple

As defined by on-chain analytics agency CryptoQuant Submit On X, the BTC Coinbase Premium Index fell into unfavourable territory, hours earlier than BTC went by a correction.

The “Coinbase Premium Index” right here refers to an indicator that tracks the proportion distinction between the costs of Bitcoin listed on the cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

When the worth of this metric is optimistic, it implies that the worth listed on Coinbase is greater than that on Binance proper now. Such a pattern implies that customers of the previous platform are making extra purchases than these of the latter.

Then again, unfavourable values point out the presence of excessive promoting stress on Coinbase because the cryptocurrency is at present priced greater on Binance.

Now, here’s a chart that reveals the pattern within the Bitcoin Coinbase Premium Index over the previous few days:

The worth of the metric appears to have been unfavourable previously day or so | Supply: CryptoQuant on X

Because the above graph reveals, the Bitcoin Coinbase Premium Index was optimistic earlier. Nonetheless, the indicator moved into unfavourable territory yesterday and has remained largely inside it since then.

With these purple values of the metric, the worth of the cryptocurrency has undergone a deep decline, because it has returned to the $68,000 stage. Given the closing time, excessive promoting stress on Coinbase could have one thing to do with this decline.

Coinbase is popularly thought of the popular platform of US-based institutional buyers, whereas Binance has extra international visitors, so the worth of the premium index could mirror variations within the habits of US whales and world customers.

On this rally, the Coinbase Premium Index has been typically optimistic as massive US-based models have gathered. Seeing the purple value change, these buyers have now began promoting as a substitute, inflicting the coin to say no.

This indicator could also be price watching within the coming days. If it turns optimistic for a sustained time frame, it will be an indication that the patrons are again and with them, so it could possibly be a bullish pattern.

Concerning the newest enchancment, Sensible-Cash Tracker lookonchain has reported {that a} Binance deposit pockets has transferred $329 million price of BTC to a Binance sizzling pockets within the final 24 hours.

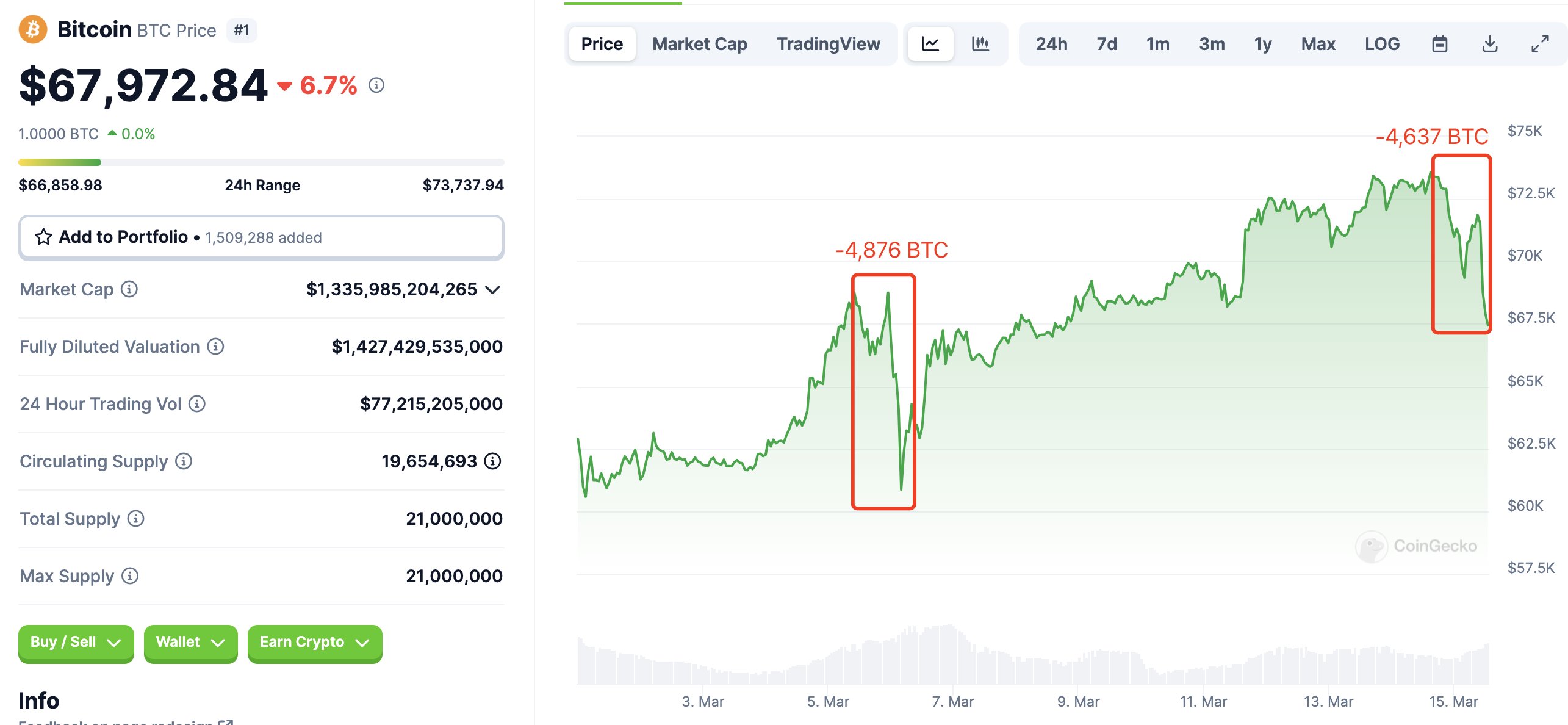

Apparently, these identical whales moved again an identical quantity of Bitcoin through the correction in the beginning of the month, because the chart beneath shared by person X reveals.

The identical whale moved cash throughout each of the main corrections on this month thus far | Supply: @lookonchain on X

btc value

On the time of writing, Bitcoin is buying and selling at round $68,100, down 4% within the final 24 hours.

Seems like the worth of the coin has plummeted previously day | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, CryptoQuant.com, Chart from Tradingview.com