[

Replace: Some presents talked about under are not obtainable. View the present presents right here.

Citi is a TPG promoting associate.

The Citi ThankYou Rewards program stays probably the greatest for bank card customers in search of versatile cash-back choices or journey rewards. This system at the moment has a number of airline switch companions and a few of these associate packages supply the very best use of ThankYou factors.

Citi at the moment presents 5 playing cards that permit you to earn ThankYou factors:

- AT&T Entry Card from Citi.

- Citi® Double Money Card.

- Citi Premier® Card.

- Citi Rewards+® Card.

- Citi Rewards+℠ Scholar Card.

- Citi Customized Money℠ Card.

Although the Customized Money card is branded as a cash-back card, you will earn rewards within the type of Citi ThankYou factors. If you happen to already carry certainly one of Citi’s journey rewards playing cards (such because the Citi Status® Card or the Citi Premier Card), you possibly can mix the factors earned on that card with the factors earned on the Customized Money.

Moreover, there are playing cards that aren’t open to new candidates, however present members can proceed incomes and redeeming factors:

- Citi Status Card.

- Citi ThankYou® Most popular Card.

- Citi ThankYou® Most popular Card for Faculty College students.

- AT&T Entry Extra Mastercard from Citi.

The knowledge for the AT&T Entry, Rewards+ Scholar, Citi Status, ThankYou Most popular, ThankYou Most popular for Faculty College students and the AT&T Entry Extra playing cards has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Day by day E-newsletter

Reward your inbox with the TPG Day by day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

The ThankYou Rewards program will not be as extremely publicized or nicely thought to be Chase Final Rewards or American Categorical Membership Rewards. Nonetheless, if you know the way to leverage your ThankYou factors by way of switch companions, you may get nice worth. On this information, we’ll discover some methods to take advantage of your factors.

Need extra bank card information and recommendation from TPG? Join our day by day e-newsletter.

Incomes Citi ThankYou factors

You may earn ThankYou factors from spending on Citi bank cards within the ThankYou portfolio or from focused account-opening bonuses.

Citi banking clients with Citigold, Citi Precedence or Citi Non-public Financial institution accounts may additionally earn extra bonuses by way of that relationship. As of March 28, 2022, the Double Money card now earns ThankYou factors immediately, somewhat than needing to transform cash-back earnings into factors.

The worth of your factors is dependent upon which ThankYou points-earning bank cards you maintain. Premium playing cards, such because the Citi Status and Citi Premier, supply extra choices to spend your factors and extra methods to extend their worth.

Each card within the ThankYou Rewards household means that you can redeem factors towards the price of airfare, inns, cruises, present playing cards, money or mortgage funds at a redemption worth of 1 cent per level. You may also request an announcement credit score or pay with factors when purchasing, however these will not be the very best methods to spend your rewards since you aren’t maximizing the factors worth.

Associated: The last word information to Citi ThankYou rewards

Sadly, the choices obtainable to you and what worth you’ll acquire out of your factors will range relying on which ThankYou points-earning card(s) you maintain. If you happen to solely maintain a card with no annual payment, you will have entry to restricted switch companions and a few lowered switch charges — this is applicable to the Double Money, Rewards+ and Rewards+ Scholar playing cards — or no capability to switch to companions in any respect. This is applicable to the AT&T playing cards and the Customized Money.

If you happen to maintain the Premier or Status card, this may open the entire switch companions to you, in addition to the improved switch charges, and you are able to do so with the factors earned throughout your entire playing cards. It is because you possibly can mix your cash-back earnings and ThankYou factors within the account related along with your higher-tier card. Then you should use your mixed factors with one of many a number of switch companions to squeeze probably the most worth out of your factors.

Citi Premier

The Citi Premier, the second-tier ThankYou points-earning card, is at the moment providing 60,000 factors after you spend $4,000 on purchases within the first three months of account opening. The Premier card earns 3 factors per greenback spent on inns, air journey, eating places, fuel stations and supermarkets and 1 level on all different spending. Plus, for a restricted time, earn 10x factors per greenback on inns, automotive leases, and points of interest (excluding air journey) booked on the Citi Journey℠ Portal by way of June 30, 2024. The incomes construction is among the large causes to get the Citi Premier. The cardboard has a $95 annual payment.

Whereas it not presents many buy safety and insurance coverage advantages, the sign-up bonus, comparatively low annual payment and excessive incomes capabilities nonetheless make this card worthwhile for incomes and redeeming factors.

Citi sign-up bonus restrictions

Earlier than you apply for the Premier card, you will wish to be sure you qualify for the sign-up bonus. You aren’t eligible in case you have obtained one for different Citi ThankYou rewards playing cards or closed a Citi ThankYou card account prior to now 24 months.

With the incomes facet of ThankYou factors defined, let us take a look at the redemption choices it is best to keep away from and those who gives you most worth.

Associated: Greatest methods to redeem Citi ThankYou factors on SkyTeam airways

Greatest methods to redeem Citi ThankYou factors

Avianca LifeMiles

Colombian airline Avianca has a loyalty program known as LifeMiles, one of the crucial undervalued airline loyalty packages. Citi has been providing transfers to LifeMiles since 2017 — lengthy earlier than American Categorical and Capital One started partnering with Avianca — and routinely presents switch bonuses.

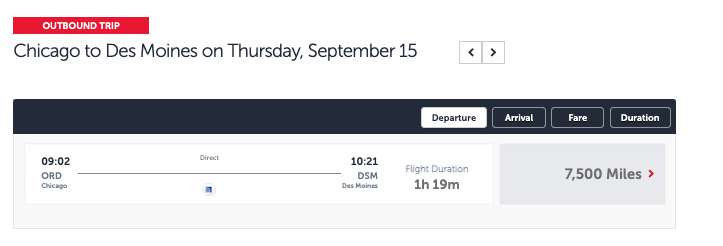

There are lots of routes value investigating, however you will discover the very best worth on home short-haul flights on Star Alliance associate United. These at the moment begin at simply 7,500 miles every means, however sure metropolis pairs dropped to six,500 miles in summer time 2019. We have even seen some fall to as little as 3,500 miles.

You may also guide Lufthansa top notch to Europe for 87,000 miles one-way with no gasoline surcharges. The Star Alliance associate award chart is filled with fairly priced award routings, and you may routinely purchase LifeMiles at an affordable value in comparison with the worth these redemptions supply. You may even rating decrease charges on mixed-cabin awards.

Associated: 6 suggestions for reserving Lufthansa first-class awards

The extra time you spend on the LifeMiles award-booking engine, the extra acquainted you develop into with a few of the nuances and nice worth this system presents. In case you are not aware of this Citi switch associate, create an account and search a number of of your upcoming routes to see what worth this system may present to you.

Singapore KrisFlyer

Singapore Suites and Singapore top notch proceed to be among the many high merchandise within the sky, they usually’re usually solely bookable by way of Singapore Airways’ personal KrisFlyer program. The airline does not launch long-haul premium-cabin award house to its companions. Costs are comparatively cheap for Singapore’s first-class routes serving the U.S., together with from New York’s John F. Kennedy Worldwide Airport (JFK) to Frankfurt Airport (FRA) for 86,000 miles in Suites class and from Los Angeles Worldwide Airport (LAX) to Tokyo’s Narita Worldwide Airport (NRT) for 107,000 miles in top notch. Even when your required routing or class of service is not open on the time of reserving, you possibly can simply waitlist for a greater award.

Singapore KrisFlyer additionally has a number of candy spots for reserving Star Alliance routes, together with 35,000 miles in economic system or 69,000 miles in enterprise for a round-trip award from the U.S. mainland to Hawaii on United. By transferring to this program, you should use ThankYou factors to fly United to Hawaii for fewer miles than United’s personal program fees.

Etihad Visitor

The Etihad Visitor program continues to fly underneath the radar however represents an amazing worth whenever you use ThankYou factors. You may fly nearly wherever on the earth for extremely cheap costs utilizing solely Etihad Visitor miles and the airline’s big selection of associate packages. This consists of routes and airways you did not know existed, corresponding to Royal Air Maroc’s Dreamliner service to Africa from JFK to Casablanca’s Mohammed V Worldwide Airport (CMN) for less than 44,000 miles in enterprise every means.

Most relevant to us right here within the U.S. is the power to guide awards on Etihad associate American at pre-AAdvantage devaluation costs. American elevated the charges of its personal award tickets, however Etihad has not up to date the Etihad Visitor American award chart (warning: PDF hyperlink). You may nonetheless fly American enterprise class one-way to Europe, Japan or South Korea by transferring 50,000 ThankYou factors to Etihad.

Virgin Atlantic Flying Membership

Utilizing factors for flights on Virgin Atlantic’s personal steel not often leads to a superb worth because of the excessive surcharges, taxes and charges you will must pay, however the Flying Membership program does have a wide range of associate awards you possibly can guide. Air New Zealand and Delta routinely produce unimaginable redemption alternatives for long-haul business-class flights with comparatively small quantities of miles, corresponding to 50,000 Virgin Atlantic miles for the Delta One suite between the U.S. and Europe (excluding the UK) or 62,500 miles for Air New Zealand business-class one-way from Auckland, New Zealand, to the U.S.

After all, you possibly can’t overlook the power to guide ANA top notch from the U.S. to Tokyo for 110,000-120,000 miles round-trip, relying on the place within the States you depart from. That is lower than most airways would cost for a one-way ticket, and it offers you an opportunity to fly on one of many world’s most refined airways.

Associated: The brand new gold customary: Evaluate of The Room, ANA’s new enterprise class on the Boeing 777-300ER

Turkish Airways Miles&Smiles

Whereas we’re together with this within the “finest” part due to the worth the Miles&Smiles program can present, it does not come with out some caveats.

This system presents quite a few candy spots when flying on Star Alliance companions, together with transcontinental business-class seats for simply 12,500 miles every means and economic system flights to Hawaii for 15,000 miles round-trip. Likewise, you possibly can guide any U.S. home route for simply 7,500 miles. Sure, these are actual costs.

Sadly, reserving the flights isn’t with out some quirks. The most important of those is the actual fact the Miles&Smiles web site is unreliable concerning what award availability it is going to present. You might have to name or e-mail to finish bookings after first verifying availability along with your favourite approach to seek for Star Alliance flights.

You also needs to know that switch instances from Citi to Turkish Airways are a day on common, and you can not put associate awards on maintain. Thus, this system can present excessive worth by way of what you possibly can guide, however the seats would possibly disappear whereas ready to your factors to switch in the event you’re making an attempt to seize the final seat obtainable.

Associated: Every thing it is advisable find out about United Polaris enterprise class

Center-of-the-road redemptions

Cathay Pacific Asia Miles

Cathay Pacific’s Asia Miles program has some attention-grabbing redemption alternatives, due to the way it defines areas and routing guidelines. However it’s tough to decipher the advanced guidelines to guide a ticket. If not for the difficult course of, I might rank it as a maximum-value redemption.

Program adjustments in June 2018 additionally elevated the price of premium-cabin redemptions and made the net reserving engine much less helpful. One other strike towards this system: There’s nonetheless no award chart for itineraries consisting of solely a single associate airline. Plus, you can not guide American Airways awards on-line; you have to name to guide these flights.

However, you could find some respectable values. As an example, you possibly can guide round-trip enterprise class to Europe for 100,000 miles. Likewise, a one-way to Europe with a stopover is barely 50,000 miles.

Dozens of gems are ready to be found in this system’s advanced guidelines, which even telephone brokers do not at all times know. If you happen to’re prepared to place within the effort, this might be a maximum-value redemption. As a result of so few take benefit, although, I am going to hold it within the decent-value class.

Air France-KLM Flying Blue

There are a number of unbelievable makes use of of the Air France-KLM loyalty program, although they’re typically tough to seek out. With this system’s dynamic pricing mannequin, you possibly can’t ensure what Flying Blue award tickets will value till you really search. That makes it arduous to proactively set a mileage purpose after which work to fulfill it. Nevertheless, you may get some respectable worth from this system’s Promo Rewards, which rotate often and usually supply 25%-50% off economy- or business-class awards from particular North American gateways to Europe and past.

This system additionally means that you can go to far-flung locations corresponding to Papua New Guinea on associate Aircalin, and you should use inventive routings to decrease the value of your ticket or probably add extra segments at no further cost. Nevertheless, gasoline surcharges could be a actual headache with this system, they usually improve for premium-cabin redemptions.

Flying Blue is not this system it as soon as was, however in the event you catch a Promo Reward or discover award house on a Delta-operated route (it’s possible you’ll have to name for home flights), this system can yield good worth.

Associated: Greatest methods to redeem Citi ThankYou factors on Oneworld airways

How to not redeem your Citi ThankYou factors

Assertion credit and Store with Factors

Though Citi has made it simpler to redeem rewards in real-time, utilizing ThankYou factors for assertion credit score or the Store with Factors program is not an excellent thought.

These will all offer you a lot lower than 1 cent per level in worth, which is low in comparison with the redemptions highlighted above. Paying immediately with ThankYou factors at BestBuy.com gives you lower than 1 cent per level, in comparison with redeeming factors for 1 cent every for Greatest Purchase present playing cards. Moreover, assertion credit score choices to erase purchases out of your bank card invoice supply 0.8 cents per level in worth, which isn’t sturdy in comparison with the choices mentioned above.

A handful of airline switch companions

All Citi airline transfers permit you to switch miles at a 1:1 ratio when holding the Status or Premier card. Nevertheless, the worth of these miles varies tremendously, as does flight availability, ease of reserving, gasoline surcharges and different charges that may drive up the price of your ticket. Redemptions with EVA Air and Thai Airways offer you a poor return.

You must keep away from transferring to those companions besides in distinctive and particular circumstances. There are a number of causes for this, together with the variety of miles required, excessive gasoline surcharges and a prolonged (learn: irritating) reserving course of. It might be value trying out these companions in particular cases, however be sure you consider different choices as nicely.

Citi ThankYou Journey Heart redemptions

Cardholders may redeem factors at a flat price of 1 cent every towards airfare by way of the Citi ThankYou Journey Heart. Which means you most actually have higher choices by transferring your factors to certainly one of Citi’s journey companions.

Little question, it is easy and handy to guide by way of the Citi Journey Heart, as you possibly can guide practically any seat on any flight and earn redeemable and elite qualifying miles in the event you’re a member of that airline’s frequent flyer program. Until the money value is so low that paying along with your factors is cheaper than transferring them, you are leaving cash on the desk utilizing your factors this manner.

Associated: Greatest methods to redeem Citi ThankYou factors on Star Alliance airways

Reconsidering cashing out factors

With the switch companions highlighted pretty much as good choices above, you possibly can often obtain TPG’s common valuation of ThankYou factors, which is 1.7 cents per level. It is also fairly possible that you’ll obtain a better worth in your factors redemptions when utilizing the choices highlighted above or redeeming for award flights in top notch or enterprise class.

We have alluded to the truth that you possibly can money out factors at a price of 1 cent apiece. However it’s really potential to do higher than that, assuming you will have the Rewards+ card. That is as a result of a key function of the Rewards+ card is that you just obtain a refund of 10% of your redeemed factors every year, on as much as 100,000 factors redeemed (so 10,000 factors refunded).

When you have a number of ThankYou points-earning playing cards and hyperlink all of them to the identical ThankYou Rewards account, this 10% factors rebate will take impact when cashing out factors out of your Premier or Status card. Thus, cashing out 10,000 factors at 1 cent apiece would offer you $100 in worth by way of financial institution deposit, however the 10% factors rebate provides one other 10% in worth to this when contemplating the larger image — particularly since you’d get an extra 10% of your factors again when redeeming the factors out of your first rebate, and this may proceed till you’ve got reached the annual most.

Can you continue to obtain larger worth by way of switch companions? Sure. Nevertheless, it is value a second have a look at this distinctive capability to mix card advantages for elevated worth when cashing out factors.

Backside line

As with most transferable-point loyalty packages, you will nearly at all times get the largest bang to your buck whenever you switch your Citi ThankYou factors to associate packages. Many award vacationers typically overlook the Citi ThankYou Rewards program or undervalue its factors.

Even in the event you determined to restrict your selections to Virgin Atlantic and Etihad Visitor and their respective companions, you possibly can attain nearly any vacation spot on the earth on fairly priced award tickets. Add in all the opposite switch potentialities and the number of candy spots in this system, and there is not any such factor as too many ThankYou factors.

Further reporting by Daybreak Allcot, Benji Stawski and Ryan Smith.