[

This text initially appeared within the Sound Advisory weblog. Sound Advisory gives monetary advisory providers and focuses on educating and guiding shoppers to thrive financially in a bitcoin-powered world. Click on right here to study extra.

One of many easiest and handiest methods to enhance your monetary state of affairs: Don’t get killed on taxes.

Taxes are a significant friction in most individuals’s monetary lives, and just a little foresight and planning can go a great distance. This text will cowl a couple of useful ideas and case research that might show you how to enhance your future tax planning.

Let’s contact on a fast refresher. Hold these two foundational ideas in thoughts as you take into account potential methods.

Price foundation: Hold detailed data of all of your bitcoin transactions

Sustaining meticulous data of each bitcoin transaction and its related price foundation isn’t just an excellent apply however an important one, given the Inner Income Service’s (IRS) authority to audit returns as much as six years again.

The reply is sure if you happen to’re questioning whether or not the IRS can observe bitcoin transactions. The IRS employs varied means to observe bitcoin actions. This is how:

- KYC Compliance: All main cryptocurrency exchanges should conduct Know Your Buyer (KYC) checks, guaranteeing that your identification is tied to your holdings.

- Transaction Historical past: Many exchanges preserve detailed data of the addresses related along with your withdrawals. This permits them to determine custodial wallets and observe extra downstream transactions.

- Reporting to IRS: Quite a few exchanges should submit 1099 kinds to customers and the IRS, offering a complete overview of taxable occasions and positive factors.

- Authorized Precedents: The IRS has efficiently litigated circumstances towards outstanding exchanges comparable to Coinbase, Kraken, and Poloniex, compelling them to reveal buyer knowledge. This authorized standing solidifies the IRS’s means to entry essential details about bitcoin holdings and transactions.

Given these measures, it’s important to acknowledge that the IRS is well-informed about bitcoin actions. Consequently, it’s prudent to strategize your bitcoin tax plan accordingly.

Many people enterprise into bitcoin investments with out totally greedy the potential tax implications. Shopping for, promoting, buying and selling various cash, and switching exchanges could appear routine, however every occasion carries distinct tax implications. Neglecting these penalties can lead to a fancy state of affairs throughout tax season.

To navigate the intricacies of bitcoin taxation, it’s crucial to ascertain and comprehend your price foundation. Taking the time to return and manage your previous transactions and sustaining clear, systematic data shifting ahead can streamline the tax reporting course of, saving you time and mitigating potential points. For those who discover the panorama of bitcoin taxes overwhelming, searching for steering from a tax skilled is a clever step to make sure that you’re well-prepared and in compliance with tax obligations associated to your bitcoin investments.

Tax tables: Not all bitcoin is taxed the identical

The IRS treats bitcoin as property, not cash, so it’s topic to capital positive factors tax (not strange earnings tax) when bought, traded, or spent. Capital positive factors are taxed beneath two potential taxation tables: short-term and long-term capital positive factors.

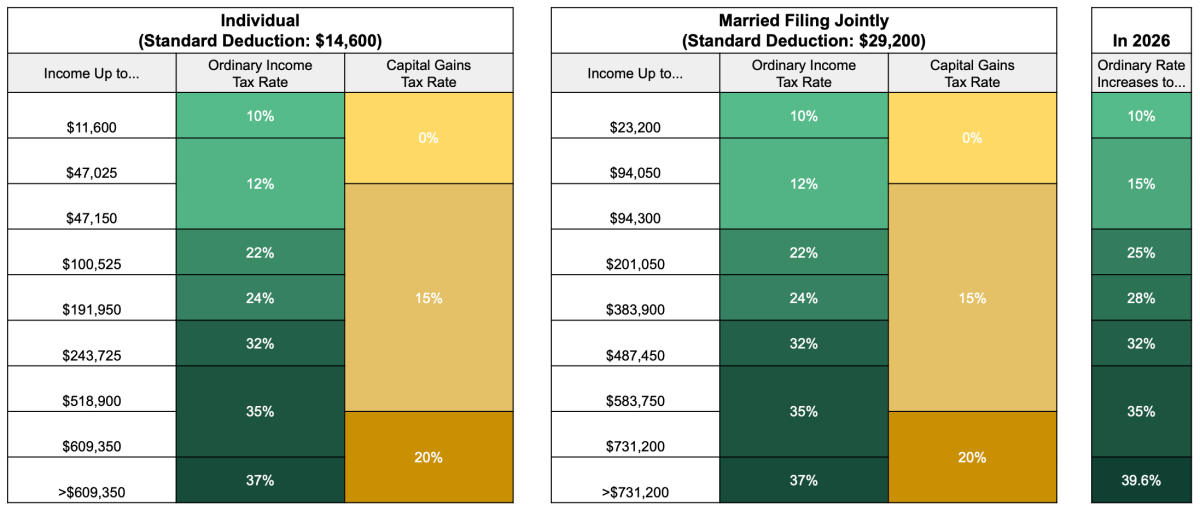

The next desk helps visualize: Brief-term positive factors on bitcoin held one 12 months or much less are taxed as strange earnings charges (inexperienced column). Confer with the yellow column if bitcoin is held for greater than a 12 months.

For those who maintain bitcoin for over a 12 months earlier than disposing of it, you’ll pay long-term capital positive factors tax, which ranges from 0% to twenty%, relying in your earnings.

Moreover, these tables solely apply to non-qualified bitcoin—bitcoin not held in a retirement account. Certified distributions from Conventional IRA bitcoin are at all times taxed as strange earnings (inexperienced), and Roth IRA distributions will be tax-free.

With that as a backdrop, let’s get into some potential methods that many bitcoiners usually overlook.

Methods and Case Research

Bitcoin tax can snowball: Consider your cost-basis technique

Buying bitcoin is like freshly fallen snow – pure and untouched. It isn’t taxable. However you incur a taxable occasion once you set foot in that snow with a promote, commerce, or spend. And just like how a snowball grows as you roll it down a hill, the tax implications of your bitcoin transactions can accumulate over time.

When accounting for transactions, it’s vital to keep in mind that every occasion will affect your price foundation.

The IRS permits for “particular identification” accounting for bitcoin, the place you retain observe of each stock merchandise—on this case, each chunk of bitcoin. Particular identification has variations like FIFO (first-in, first-out), LIFO (last-in, first-out), and HIFO (highest-in, first-out) when matching inclinations (sells, trades, spends) with acquisitions (buys, earnings). With an excellent identification report, you’ll be able to run projections to see which methodology provides you the bottom positive factors.

Situation: Adam purchased 1 BTC in January 2023 for $16,000 and one other 2 BTC in March 2023 for $48,000. He bought 1 BTC in August 2023, when 1 BTC is value $30,000.

- With FIFO, Adam has a $14,000 capital acquire (sale worth of $30,000 much less price foundation of $16,000).

- With LIFO, Adam has a $6,000 capital acquire (sale worth of $30,000 much less price foundation of $24,000).

- HIFO is identical as LIFO on this case.

These could be short-term capital positive factors, so let’s assume a hypothetical 22% federal tax price. Adam will pay $1,760 much less tax by selecting LIFO over FIFO.

It’s fairly easy when there are just a few transactions, however it may simply grow to be sophisticated with each extra purchase, promote, or spend. Price foundation and the following transaction matching is an evolving calculation that might have drastic penalties if executed incorrectly.

Tax loss harvesting

Not too long ago, bitcoin has been buying and selling close to its all-time highs. So, this technique is much less related, however we’ll go away it right here for future readers.

In a tax loss harvesting technique, you’ll be able to promote at a loss to offset different earnings or capital positive factors and decrease your tax legal responsibility. When you have realized capital positive factors from promoting bitcoin this 12 months, take a look at cash you are still holding which can be buying and selling under their buy worth.

Situation: Hal has a $15,000 short-term acquire from promoting a inventory earlier than holding onto it for a 12 months. In December, he decides to promote some bitcoin at a $12,000 loss. This offsets $12,000 of his inventory acquire, so he solely must pay capital positive factors tax on the remaining $3,000 acquire as an alternative of $15,000. At a 22% tax price, $2,640 is saved.

Simply since you had a loss this 12 months does not imply you essentially wish to use that loss this 12 months. You’ll be able to take a look at utilizing the tax loss carry ahead approach. As much as $3,000 in annual losses can offset your different earnings (issues like wages, rental earnings, and so forth.). Nonetheless, any quantity over $3,000 have to be carried ahead for use in future years. Some strategic shoppers could determine to reap and report losses now so you’ll be able to scale back taxes and carry them ahead to offset future positive factors.

If making an attempt to reap losses, please concentrate on the wash sale rule, described in additional element on the finish of this text.

Tax acquire harvesting: The 0% tax bracket

A peculiar tax price within the capital positive factors desk above is 0.00% tax on long-term capital positive factors.

For 2024, if whole taxable earnings falls beneath $94,050 as a married couple ($47,025 single), you’ll be able to promote long-term capital property, and positive factors are taxed at 0% federally. Paying a 0% tax ain’t so unhealthy. Signal me up. I’ll even pay it twice.

And “taxable earnings” is calculated after the usual deduction, which provides one other $29,200 for married ($14,600 single).

Situation: Let’s assume Stacey and Max are married with $100,000 mixed in W2 earnings from their jobs on the embassy. They promote some bitcoin all year long and notice a $16,000 long-term capital acquire. Some fast math: $100,000 (W2) plus $16,000 (cap acquire) is $116,000. Take out the usual deduction of $29,200, and the taxable earnings is $86,800. Since their whole taxable earnings for the 12 months is under the $94,050 threshold, their bitcoin positive factors are taxed at 0% (tax-free). And we’ll assume that they dwell in one of many 9 US states that don’t have an earnings tax, so let’s name it 0% state tax as properly.

It’s potential to promote non-retirement bitcoin tax-free—invaluable data for these trying to promote. If you’re in a state of affairs the place you assume these earnings ranges/brackets could apply to you (now or sooner or later), a strategic promote and speedy rebuy alternative awaits: the tax acquire harvest.

Typically, it is sensible to promote bitcoin, acknowledge a acquire at 0% charges, and instantly purchase it proper again. By repurchasing the bitcoin instantly, you successfully set a brand new price foundation to your funding. This new foundation is increased than your authentic buy worth. Sooner or later, if bitcoin’s worth continues to rise and also you determine to promote once more, you will be taxed on a smaller acquire, due to the sooner positive factors harvesting.

Good points harvesting is: promote your bitcoin, reap the benefits of the 0% bracket, and purchase it proper again (wash sale guidelines solely disallow losses – not positive factors).

The specified end result right here is a rise in tax foundation. Sooner or later, you will be taxed on a smaller future acquire, due to the sooner positive factors harvesting.

A main alternative for positive factors harvesting usually comes throughout retirement. When folks cease working, they usually cease receiving earnings from their jobs (say goodbye to these W2s!). This important drop in earnings might place them in that coveted 0% tax bracket. With that additional room, they’ll maximize their tax methods not simply with positive factors harvesting but additionally with different earnings structuring methods Roth IRA conversions or liquidating property by way of installment gross sales.

Gifting

We’ll cowl three goal present recipients: charitable organizations, donor-advised funds, and different folks.

Charity

While you donate bitcoin to a qualifying charitable group, you’ll be able to deduct the total truthful market worth of the donation. It will can help you keep away from paying capital positive factors tax on the appreciation earlier than gifting but nonetheless get the write-off. Donating bitcoin immediately quite than money proceeds from promoting it’s extra advantageous, because the latter would set off capital positive factors tax. Simply keep in mind to acquire a receipt from the charity to your data and get a particular valuation evaluation if wanted.

Situation: Jack purchased 1 bitcoin in 2015 for $200. It is now value $70,000. He donated 0.25 BTC to a charity this December and bought a receipt displaying its worth of $17,500. Jack claims a $17,500 charitable deduction. If he had bought the bitcoin and given money as an alternative, he’d pay tax on $17,450 in capital positive factors.

You’ll be able to successfully give extra worth by gifting quite than promoting and giving money.

“However I don’t wish to have much less bitcoin!”

If bitcoin holders are accustomed to “spend and substitute,” we are able to take into account the same technique like “donate and substitute.” You’ll be able to present appreciated bitcoin and repurchase with money to extend the fee foundation (just like the above instance – positive factors harvesting), thus decreasing future taxes.

Donor-advised funds

For normal or substantial contributors to charitable causes, a donor-advised fund (DAF) presents a mechanism for amplifying their philanthropy. Consider a DAF as a “charitable financial savings account”: You make a contribution with property, safe an instantaneous tax profit, after which, at your discretion, advise on investing these property and distributing the grants to charities of your alternative over time.

Incorporating bitcoin into this construction introduces an thrilling dynamic. Given its potential for important appreciation, designating it as an asset inside a DAF can exponentially enlarge the fund’s development potential. The end result? A bigger reservoir of assets devoted to driving optimistic change on the planet, all whereas effectively navigating tax implications.

Family and friends

Giving bitcoin to others transfers the unique tax foundation and will get bitcoin out of the property.

As an alternative of promoting bitcoin and realizing positive factors, you’ll be able to present bitcoin as much as the annual present exclusion quantity of $18,000 per particular person per recipient. The present tax annual exclusion is the quantity it’s possible you’ll give annually to people and sure sorts of trusts tax-free with out utilizing any of your present and property tax exemption. Because the giver, you don’t owe taxes on items beneath the exclusion quantity of $18,000. The recipient inherits your price foundation and can owe capital positive factors once they ultimately promote (maybe at a decrease bracket/price than you).

Situation: A married couple, the Nakamotos, wish to give a major quantity of bitcoin to their daughter Kristina and her new husband. Annual exclusion quantities are $18,000 per particular person. Successfully, the Nakamotos can present $72,000 with out dipping into their “lifetime bucket.” Dad to Kristina. Dad to husband. Mother to Kristina. Mother to husband. $18,000 every.

Roth accounts

Utilizing a Roth IRA can remove ALL future tax legal responsibility.

If eligible, contributing to a Roth IRA or 401k permits for tax-free appreciation and distribution if held to age 59.5. Since Roth accounts present tax-free development, they are perfect for long-term bitcoin holdings.

For those who personal bitcoin exterior an IRA that you just wish to maintain long run, you could possibly promote the bitcoin, contribute the USD proceeds to the Roth IRA, and repurchase the bitcoin contained in the Roth. This eliminates the bitcoin cost-basis monitoring requirement and permits future appreciation to be tax-free upon certified distribution.

Conclusion

The utmost contribution to an IRA in 2024 is $7,000 per particular person ($8,000 if over 50), and you’ve got till April 2025 to make 2024 contributions. Seek the advice of your monetary or tax advisor to see if this technique fits you.

With correct tax planning, bitcoin traders can maximize after-tax returns and reduce tax legal responsibility. Work carefully along with your tax skilled to implement the appropriate methods based mostly in your state of affairs. Hold meticulous data and perceive the nuances round price foundation, tax loss harvesting, retirement accounts, charitable gifting, and different strategies. The bitcoin tax guidelines will be advanced, however the long-term rewards of correct planning are properly definitely worth the effort.

A observe on wash gross sales

The wash sale rule prevents claiming a capital loss if you happen to repurchase the identical safety inside 30 days earlier than or after the sale. This rule at present applies solely to securities, not commodities like bitcoin.

Some bitcoin traders have taken benefit of this loophole by promoting at a loss and instantly repurchasing whereas claiming the capital loss to cut back their tax legal responsibility. This tax loss harvesting technique is extraordinarily dangerous and never really helpful.

Although wash gross sales usually are not explicitly prohibited for bitcoin but, the IRS might decide this sample violates the essence of wash sale guidelines beneath the step transaction doctrine. Participating in systematic wash gross sales to reap losses might set off penalties and curiosity if recognized in an audit.

It’s safer to keep away from wash gross sales of bitcoin, despite the fact that technically allowed now. Don’t promote at a loss and reacquire the identical bitcoin inside 30 days earlier than or after the sale. Seek the advice of a professional tax advisor earlier than making an attempt any tax methods involving cryptocurrency.

1) Transferring bitcoin between your wallets will not be taxable. Solely transfers between separate events are taxable occasions.

2) These charges solely have an effect on federal taxation. Capital positive factors are taxed in various methods and charges on the state stage. Please seek the advice of your tax skilled relating to state taxation, as it might change the suitable methods and suggestions to your state of affairs.

CONTACT

Workplace: (208)-254-0142

408 South Eagle Rd.

Ste. 205

Eagle, ID 83616

hi there@thesoundadvisory.com

Examine the background of your monetary skilled on FINRA’s BrokerCheck. The content material is developed from sources believed to be offering correct data. The knowledge on this materials will not be meant as tax or authorized recommendation. Please seek the advice of authorized or tax professionals for particular data relating to your particular person state of affairs. A few of this materials was developed and produced by FMG Suite to offer data on a subject which may be of curiosity. FMG Suite will not be affiliated with the named consultant, dealer – vendor, state – or SEC – registered funding advisory agency. The opinions expressed and materials supplied are for common data, and shouldn’t be thought-about a solicitation for the acquisition or sale of any safety.

We take defending your knowledge and privateness very significantly. As of January 1, 2020 the California Client Privateness Act (CCPA) suggests the next hyperlink as an additional measure to safeguard your knowledge: Don’t promote my private data.

Copyright 2024 FMG Suite.

Sound Advisory, LLC (“SA”) is a registered funding advisor providing advisory providers within the State of Idaho and in different jurisdictions the place exempt. Registration doesn’t indicate a sure stage of talent or coaching. The knowledge on this website will not be meant as tax, accounting, or authorized recommendation, as a proposal or solicitation of a proposal to purchase or promote, or as an endorsement of any firm, safety, fund, or different securities or non-securities providing. This data shouldn’t be relied upon as the only think about an investment-making choice. Previous efficiency isn’t any indication of future outcomes. Funding in securities includes important threat and has the potential for partial or full lack of funds invested. It shouldn’t be assumed that any suggestions made might be worthwhile or equal any efficiency famous on this website.

The knowledge on this website is supplied “AS IS” and with out warranties of any type, both specific or implied. To the fullest extent permissible pursuant to relevant legal guidelines, Sound Advisory LLC disclaims all warranties, specific or implied, together with, however not restricted to, implied warranties of merchantability, non-infringement, and suitability for a selected objective.SA doesn’t warrant that the knowledge on this website might be free from error. Your use of the knowledge is at your sole threat. In no way shall SA be chargeable for any direct, oblique, particular or consequential damages that end result from using, or the shortcoming to make use of, the knowledge supplied on this website, even when SA or an SA licensed consultant has been suggested of the opportunity of such damages. Info contained on this website shouldn’t be thought-about a solicitation to purchase, a proposal to promote, or a advice of any safety in any jurisdiction the place such provide, solicitation, or advice could be illegal or unauthorized.