[

Under is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal's premium markets publication. To be one of many first to obtain these insights and different on-chain Bitcoin market evaluation straight to your inbox, Subscribe now.

Bitcoin has loved one other spherical of intense and record-breaking success, pushed by each optimistic developments in worldwide commerce and more and more giant commitments from the sector of conventional finance.

It’s actually superb how effectively Bitcoin is performing within the first quarter of 2024. The yr began with Bitcoin's valuation crossing the $40k mark, and March 1st noticed it constantly hovering round $60k. Nonetheless, Bitcoin has now gone as much as $72k, the very best valuation in its complete historical past. Though we’re nonetheless not on the degree the place “digital gold” is extra beneficial than gold, we’ve got additionally reached a brand new milestone: Bitcoin is at the moment a extra beneficial commodity than silver, in keeping with market cap. Contemplating the immense function silver has performed in international forex for hundreds of years, that is actually a milestone price remembering.

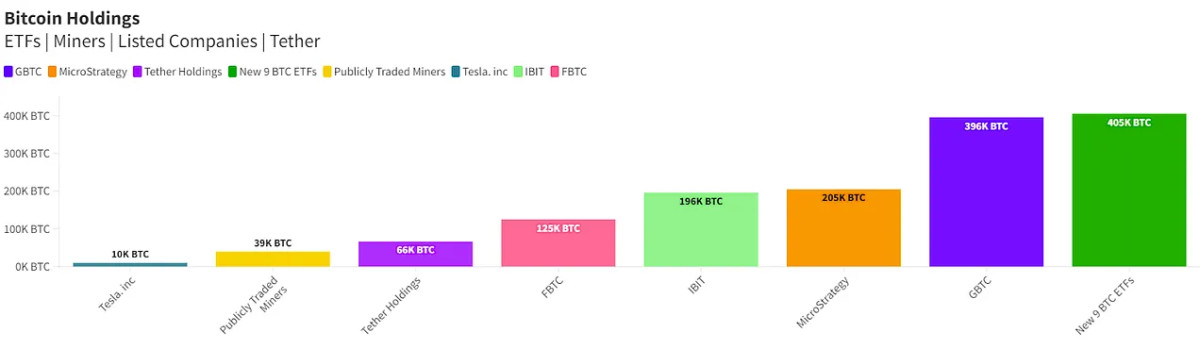

This era of success has been notably notable for the continued belief it has obtained from a number of the world's largest monetary establishments. For instance, on March 10 it was reported that BlackRock, the world's largest asset supervisor and main issuer of Bitcoin spot ETFs, had lastly acquired a lot Bitcoin that it overtook MicroStrategy's holdings. Provided that its chairman of the board, Michael Saylor, is a Bitcoin evangelist, this growth appeared particularly large. Nonetheless, it was a fair larger shock when Saylor introduced that it was shopping for sufficient to regain its main place the very subsequent day. Lower than 24 hours handed between this unique announcement and MicroStrategy's buy of 12k Bitcoin, and this buy occurred when Bitcoin was already having fun with a value level above $70k. The acquisition put MicroStrategy on the head of nearly each different personal Bitcoin repository, from all publicly traded miners to a number of main exchanges and ETF issuers.

It’s an astonishing show of confidence in Bitcoin that anybody is keen to make such a big funding at a time when it has by no means been so costly. It appears the temper at these firms is that at this time's all-time excessive will seem to be a pittance in just a few years. For instance, analysts at ETF issuer Bitwise have been so assured of their prediction that company entities representing trillions of {dollars} would start growing investments, which Bitwise's chief funding officer issued an official assertion. memorandum on this topic. Claiming to be in “severe due diligence” talks with everybody from hedge funds to giant companies, the memo predicts the second quarter will see much more huge inflows than the primary three months of the yr. This simply leaves us with one query: The place does this type of confidence come from?

Central to the problem seems to be the immense success of Bitcoin ETFs and BlackRock's dominant place over the primary issuers specifically. Initially, it needed to take care of Grayscale, which had a number of pure benefits: it was a Bitcoin-native firm with an enormous stockpile, it was truly a de facto chief within the authorized struggle to get SEC approval, its GBTC was an already Funds that existed have been transformed into ETFs, and different methods have been additionally concerned. Nonetheless, BlackRock is the ETF that reached $10 billion quicker than some other ETF in historical past, method forward of all different Bitcoin opponents and certainly all ETFs normally. Nearly all of this income got here from customers fleeing GBTC's excessive charges, and it appears to be like like a assured trade chief at this time. Its success has additionally matured internationally, as Mudrex, a crypto funding platform based mostly in India, is opening gross sales of BlackRock ETFs to institutional and personal buyers within the nation of greater than 1 billion individuals.

Such success, particularly for BlackRock, has additionally led a few of its opponents to vary their strategic approaches. For instance, VanEck created a Announcement On March eleventh that they have been waiving all charges on their Bitcoin ETF for a complete yr. This can solely final so long as their VanEck Bitcoin Belief is beneath $1.5 billion, however the charges after this window will nonetheless be the bottom accessible. Grayscale, for its half, is making an attempt to handle the issue of excessive charges by spinning off a “mini-version” of its ETF that gives a fraction of Bitcoin for a fraction of GBTC’s charges. It appears that evidently BlackRock's opponents usually are not but prepared to simply accept a market with such large development potential.

Nonetheless, whereas the ETF market has been notably sizzling just lately, that's not the one motive to consider Bitcoin is performing so effectively. ABC InformationFor instance, some optimistic developments from the UK are thought-about a significant factor within the surge within the value of Bitcoin. The UK was beforehand thought-about a very hostile regulatory surroundings for Bitcoin, particularly ETFs, lagging behind each Western Europe and many of the Anglosphere in official Bitcoin approval. It got here as fairly a shock when the London Inventory Change (LSE) launched a brand new factsheet on exchange-traded notes (ETNs), deciding that any such monetary instrument can be provided on their platform.

ETNs differ considerably from ETFs, even ones just like the Bitcoin Futures ETF, which don’t have any direct ties to Bitcoin. ETNs are a kind of debt safety and don’t even embody a provision that the issuer truly holds the Bitcoins in query. However, they’re immediately tied to the worth of Bitcoin and supply buyers a technique to achieve publicity to the world's main digital asset. Provided that these ETNs are topic to the stringent laws governing securities, it’s notably fascinating that the LSE has out of the blue modified its stance on Bitcoin-related monetary merchandise. In different phrases, evidently the massive change to authorized Bitcoin spot ETFs in the US has undeniably modified the maths for companies around the globe. With all these billions flowing into Bitcoin ETFs, even an unfriendly regulator like Nice Britain should be part of within the enjoyable if it needs to take care of relevance as a number one heart of worldwide finance.

These are simply a number of the developments which have taken place on the earth of Bitcoin, because the hole between decentralized forex and conventional finance has grown each wider and deeper. Wanting forward, there are nonetheless loads of upcoming occasions to additional the promotion, as was predicted in April. It could be troublesome to foretell the place the following large development and value surge will come from, however proper now it appears to be like like confidence is rising from some true monetary giants. Bitcoin has come an extremely great distance since its days of full untouchability, and is now price over a trillion {dollars} in the marketplace. With development like this, betting on Bitcoin is a simple win.