[

Beneath is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal's premium markets e-newsletter. To be one of many first to obtain these insights and different on-chain Bitcoin market evaluation straight to your inbox, Subscribe now.

Digital Forex Group, a enterprise capital agency, has filed a movement to dismiss a prison case filed towards them by the New York Legal professional Basic's Workplace.

The authorized battle between the DCG and the NYAG has been ongoing for a number of months, and is immediately entangled within the dispute between two different main crypto corporations: Genesis, a now-defunct brokerage agency, and Gemini, the alternate and financial institution. The teams have been embroiled in a collection of controversies over time, together with dramatic relationship adjustments and allegations of significant fraud. A very related twist to the entire scenario is the truth that bankrupt Genesis is and has been a subsidiary of the pretty highly effective DCG, which has billions of property underneath administration and counts ETF issuer Grayscale as one other subsidiary. .

In different phrases, checking out the background of all of the completely different gamers concerned right here is a reasonably important endeavor, particularly given the fraught setting that at the moment exists. Not solely is the Legal professional Basic's lawsuit directed towards DCG, Genesis, and Gemini alike, however Genesis and Gemini additionally face impartial civil lawsuits from it. The NYAG charged these firms in October 2023 with collectively defrauding buyers of greater than $1 billion, and the mutual accusations concerned have created a messy setting. To begin with, a latest revelation in court docket filings relating to this dismissal is nothing in need of good. Notably, court docket paperwork this March made it public that Genesis and Gemini are contemplating a merger in 2022.

In 2022, DCG CEO Barry Silbert had a gathering over lunch with Gemini co-founder Cameron Winklevoss to debate a few of the motivations and logistical points for merging the 2 company entities collectively. On the time, Genesis was in critical hazard of chapter, and its substantial partnership with Gemini meant that the opposite firm's enterprise was prone to undergo consequently. Gemini lent a considerable sum of money to Genesis as a part of the Gemini Earn program, which Genesis misplaced. Hedge fund Three Arrows Capital was accountable for the cash when it tanked after the collapse of FTX and Genesis confronted a $1 billion dilemma. As for the unique supply of those misplaced funds, the NYAG has accused the businesses of defrauding this cash from buyers.

On the assembly, Silbert made the gross sales pitch that the 2 firms ought to mix, and they might “be a juggernaut and be aggressive with Coinbase and FTX”. He stated that, even when Genesis and Gemini couldn’t attain an settlement on these phrases, “Gemini and Genesis can do far more collectively and the 2 firms ought to lean collectively, not aside”. Though the Winklevosses had been reportedly “eager” on the proposed deal, it didn’t occur. Confrontation arose within the quick aftermath, with Genesis declaring chapter.

A selected level of friction is discovered within the aforementioned Gemini Earn partnership, which made headlines this February when Genesis gained a court docket ruling towards Gemini. Primarily, Genesis had a tranche of Grayscale Bitcoin Belief (GBTC) shares that it had promised to Gemini as collateral for the alternate of funds between the 2 firms, however the shares truly modified fingers. Earlier than the alternative, Genesis declared chapter. Since GBTC is exclusive amongst Bitcoin spot ETFs in {that a} pre-existing fund was transformed into an ETF, this tranche of shares might grow to be price greater than $1.2B by early 2024. DCG's possession of each Grayscale and Genesis created further complexity on this challenge. Gemini objected to Genesis's authorized proper to promote the shares it had been promised years earlier, and launched a prolonged civil lawsuit.

Though the problem was resolved by way of a collection of settlements that allowed Genesis to make gross sales and prevented each it and Gemini from admitting blame, NYAG nonetheless filed a grievance alleging It was held that every one events concerned had been collectively responsible of considerable fraud. Greater than a billion {dollars} had been lacking, and the Legal professional Basic's Workplace was bored with the mutual accusations between the events concerned. Even when Genesis might make sufficient cash from its sale to repay its buyers, it nonetheless doesn’t tackle the problem of prison exercise. A selected instance of the hostile setting occurred when DCG, Genesis's dad or mum firm, disputed Genesis's personal settlement with NYAG.

So, this brings us to the current day. On March 7, Silbert and DCG filed a movement to dismiss the Legal professional Basic's lawsuit, claiming that the allegations towards these firms had been utterly baseless. Within the movement, DCG's authorized crew claimed that “the allegations towards DCG on this case are a skinny internet of baseless insinuations, blatant misconceptions and unsupported conclusory statements. To find a headline-worthy scapegoat for hurt induced to others, the OAG (Workplace of the Legal professional Basic) seeks to falsely painting DCG's good religion assist for a subsidiary as collaborating in fraud. They particularly declare that DCG acted in good religion by funneling cash towards Genesis after Three Arrows' collapse, “investing a whole bunch of hundreds of thousands of {dollars} of further capital in its subsidiary in the course of the months earlier than its chapter, though The DCG had no accountability to take action. Subsequently”. The Legal professional Basic took a special view, that DCG's internet contribution hid a big withdrawal of Genesis's cash at a crucial second: DCG withdrew its cash, Genesis declared a “liquidity disaster” and customers had been pressured to withdraw their crypto. Not allowed to withdraw, Genesis went bankrupt instantly. Nonetheless, the burden is on them to show that this was a deliberate fraudulent technique.

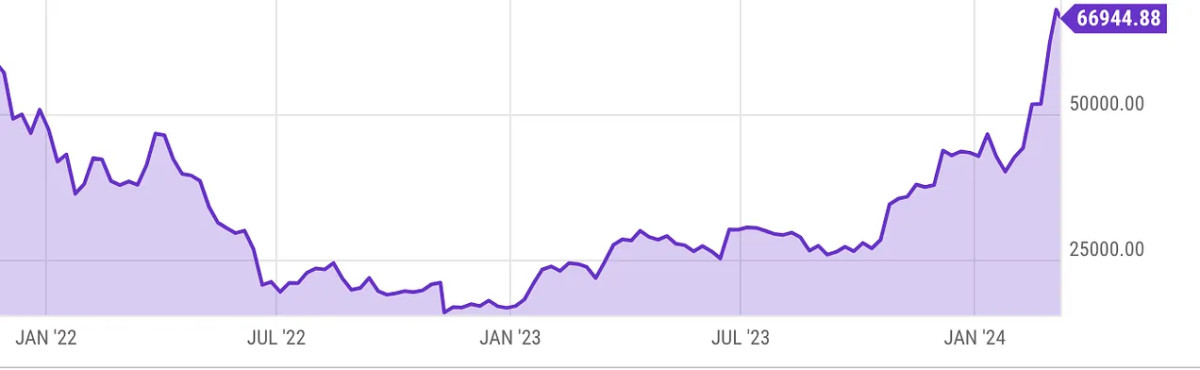

As of now, there isn’t any option to know what a decide will consider DCG's proposed protection or movement to dismiss, or whether or not a settlement is feasible if the movement to dismiss is denied. Nonetheless, one clearly good signal has emerged from this quagmire: Gemini introduced its plan to completely reimburse allegedly defrauded customers of the Gemini Earn partnership within the type of property. In different phrases, Bitcoin was stolen from these customers in 2022, and Gemini has dedicated to paying them again because of the surge in Bitcoin worth since then. This has added an extra $700M to the value tag to offset over $1B in property, and is a transparent signal of confidence from the corporate.

If nothing else, this choice to reimburse customers on this approach is a formidable show of honesty and good intentions on Gemini's half. Gemini is known as as a co-defendant on all authorized paperwork submitted by Silbert's authorized crew relating to the NYAG lawsuit, and they might additionally profit enormously if the lawsuit had been dismissed. This gesture of goodwill is probably not sufficient to clear up the scenario for DCG and Genesis, however it definitely can't harm anybody's possibilities of escaping the entire fiasco with out prison punishment. Though Gemini did not cease Genesis' try to receive cash from the sale of GBTC, Gemini remains to be a profitable and dominant alternate. Apparently, it was in a position to launch compensation of this dimension with out counting on the GBTC tranche.

It's anybody's guess how the trial will progress within the coming months. When NYAG first filed the grievance after the primary spherical of settlements, it appeared clear that prosecutors had been fed up with the caustic angle of those former enterprise companions. Nonetheless, Gemini's restoration plan will certainly go a great distance in proving their intentions to do proper by their customers. If nothing else, it reveals that they’re proactive in taking the problem severely. We should fastidiously monitor the scenario because it develops, however it appears clear that the mutual hatred and vanity displayed to this point has not been rewarded. The broader digital asset house has been full of shaky companies and outright scams sometimes, however finally all of them fell aside. Bitcoin, however, has seen success legitimately. When the mud settles, the largest winners may very well be defrauded customers, who will collectively see nearly double their anticipated payout as a result of Bitcoin's personal power. In comparison with these sorts of advantages, it's laborious to think about a rip-off working a lot better.