[

The funding recreation is experiencing a serious shift amid huge adjustments within the crypto market. Spot Bitcoin ETFs exist already, signaling Bitcoin's leap into mainstream finance and bringing it nearer to conventional investments. We are going to take a look at the tip of the iceberg whereas attempting to visualise its true depth in addition to the present relationship between Bitcoin, shares, and gold. We'll attempt to discover out if the standard market is basically transferring Bitcoin out of its decentralized area of interest, or if there's nonetheless some hope that it might probably keep its distinctive path.

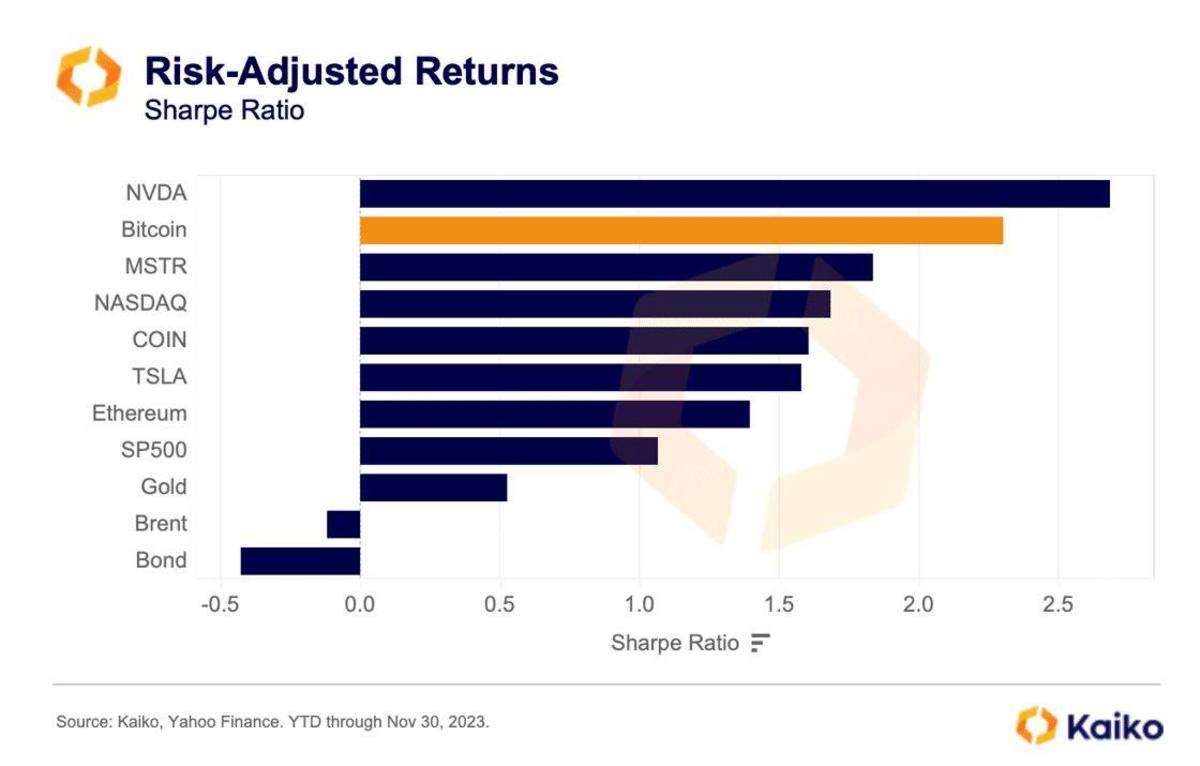

Based on Kaiko knowledge, Bitcoin's risk-adjusted returns had been higher than conventional property. Nvidia led with the very best returns on a risk-adjusted foundation, whereas Bitcoin impressively lagged behind, outperforming main conventional property just like the S&P 500, Gold, whose worth elevated by greater than 160% in risk-adjusted phrases.

In the meantime, based on the IMF Crypto Cycle and US Financial Coverage Research, 80% of the variation in crypto costs and its rising correlation with fairness markets coincides with the entry of institutional buyers into crypto markets since 2020. Notably, buying and selling quantity by establishments on crypto exchanges elevated by greater than 1,700% (from roughly $25 billion to greater than $450 billion) throughout Q2 2020 and Q2 2021. Based on the research, US financial coverage impacts the crypto cycle identical to international fairness cycles. , however surprisingly, solely the financial coverage of the US Fed issues, not different main central banks – maybe as a result of crypto markets are extremely depending on the USD.

Moreover, the 2023 Institutional Investor Digital Belongings Outlook Survey signifies that 64% of buyers are prepared to extend their stake within the crypto sector inside three years, and can allocate as much as 5% of AUM to crypto. It mentioned many establishments made first-time investments final 12 months, whereas others added to their present investments. Whereas the research highlights a rise in crypto dedication of 41% of asset managers, solely 27% of asset house owners are rising their stakes.

Though Bitcoin was born with the thought of spreading energy equally, current research point out that it’s step by step changing into dominated by a choose few huge gamers.

altering correlation dynamics

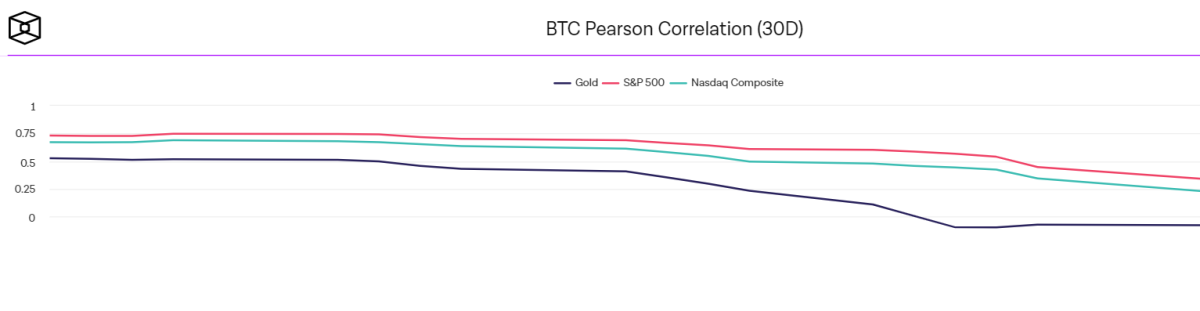

Apparently, Bitcoin retains tempo with the S&P 500 and Nasdaq with a formidable correlation. In the meantime, the correlation between Bitcoin and gold has declined sharply not too long ago, opposite to claims that buyers view the crypto as a protected haven or hedge towards inflation, a job historically performed by gold. Is.

Particularly, Bitcoin's correlation with gold was constructive at 0.83 on November 7, 2023, however dropped to -0.1 on January 10, 2024, earlier than reaching a slightly increased constructive degree of 0.14 on February 9, 2024. . In the meantime, Bitcoin's correlation with the S&P 500 noticed a adverse correlation of -0.76 on November 11, 2023, after which reached a constructive correlation of 0.57 in January 2024. This alteration from adverse to constructive correlation signifies the altering notion of Bitcoin amongst buyers.

The Nasdaq Composite, identified for its know-how and progress shares, additionally displayed a variable correlation with Bitcoin. The adverse correlation of -0.69 on October 30, 2023 shifted to a constructive 0.44 in January. Merchants appear to be connecting the rhythm of Bitcoin to the heart beat of the tech sector, pointing to a brand new kinship in funding methods.

When the correlation between Bitcoin and conventional fairness markets just like the S&P 500 and Nasdaq will increase whereas its correlation with gold decreases, it means that Bitcoin is behaving like a danger asset moderately than a protected haven. When buyers are feeling adventurous, they typically flip to shares and digital cash for the chance for higher earnings.

If institutional and retail buyers have gotten more and more concerned in each the fairness and cryptocurrency markets, their simultaneous shopping for and promoting choices might align the worth actions of those property.

The inexperienced gentle for a spot Bitcoin ETF is rising its attractiveness to massive buyers, with a big portion already planning to step up their Bitcoin recreation. Bitcoin's transfer to ETFs might make it act like a inventory as a result of these funds are huge gamers within the inventory world.

Amid these developments, the essence of Bitcoin and different cryptocurrencies being free from the confines of conventional monetary programs could also be weakening. Moreover, these adjustments might expose Bitcoin to the identical systemic dangers it was designed to keep away from.

closing ideas

As we see how spot Bitcoin ETFs might shake up Bitcoin's function available in the market and its present relationship with shares, we have to mood our enthusiasm for the potential progress with extra huge gamers leaping in and staying true to Bitcoin's origins. There’s a have to hold a detailed eye on balancing. The precept of no central management. Bitcoin's transfer in direction of a extra centralized funding panorama might create a stir available in the market, which can present shiny alternatives, but in addition tough challenges forward.

This can be a visitor publish by Maria Carola. The opinions expressed are solely their very own and don’t essentially mirror the opinions of BTC Inc. or Bitcoin Journal.