[

Ethiopia is rising as Africa’s most promising bitcoin mining hub, poised to assert a major share of the worldwide hashrate because the hum of miners reverberates throughout the globe.

– Jaran Mellerud & Kal Kassa

Current consideration from a Bloomberg article and the announcement of a bitcoin mining funding by the Ethiopian Authorities alerts a newfound international highlight on the Ethiopian bitcoin mining sector.

The potential of Ethiopia as a bitcoin mining hub resides within the promise of a mutually helpful relationship between the nation and the business. On this article, we delve into the transformative energy of bitcoin mining to uplift Ethiopian society, unveiling 5 compelling avenues for prosperity on this East African gem.

Bitcoin mining monetizes Ethiopia’s surplus electrical energy

Bitcoin mining permits Ethiopia to remodel extra electrical energy right into a priceless commodity, fostering financial development whereas maximizing the utilization of its considerable hydropower reserves.

Ethiopia’s attract for bitcoin miners is undeniably anchored in its considerable hydropower sources. Nestled throughout the nation’s mountainous terrain lies the supply of the Blue Nile, accounting for a staggering 85% of the Nile’s water. This considerable water wealth interprets into the immense potential for hydropower technology, making Ethiopia a first-rate vacation spot for electricity-intensive industries like bitcoin mining.

With the potential to harness an estimated 60 GW of hydropower, geothermal, wind, and photo voltaic, Ethiopia stands as a powerhouse that would theoretically turn into able to producing greater than 3 times the electrical energy consumed by your complete bitcoin mining community. Presently, the nation has tapped right into a fraction of this potential, having an electrical energy technology capability of 5.3 GW.

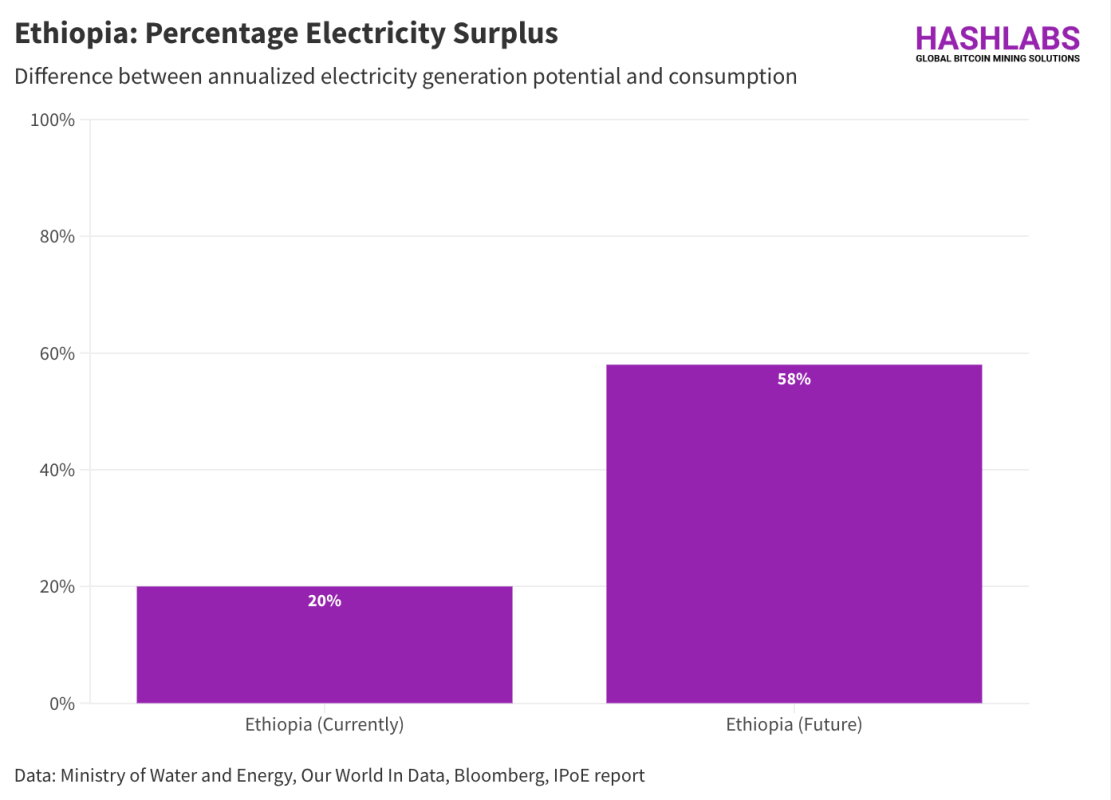

Assuming a capability issue of 40%, Ethiopia’s present electrical energy technology capability interprets to a possible of 18.6 terawatt-hours (TWh) per yr beneath regular rainfall circumstances. Comparatively, in 2022, the nation’s electrical energy consumption amounted to solely 14.7 TWh, leaving roughly 20% of the electrical energy technology potential unutilized. This quantity shall be even larger throughout notably moist years.

As if Ethiopia’s electrical energy surplus wasn’t already substantial, the nation is on the point of practically doubling its technology capability with the commissioning of The Grand Ethiopian Renaissance Dam. This awe-inspiring undertaking will declare the title of Africa’s largest hydropower plant, boasting a formidable nameplate capability of 6.5 GW.

With an anticipated capability issue of 29%, sustained by the continual inflow of water to the dam, the facility plant is projected to yield roughly 16.5 terawatt-hours (TWh) of electrical energy yearly. This output is the same as 10% of the consumption of the Bitcoin mining community, underscoring Ethiopia’s potential to turn into a dominant power in each vitality manufacturing and bitcoin mining.

The forthcoming Grand Ethiopian Renaissance Dam’s anticipated 16.5 TWh of electrical energy manufacturing will propel Ethiopia’s complete potential technology to a staggering 35.1 TWh yearly beneath typical rainfall circumstances. With present consumption at 14.7 TWh, the excess electrical energy technology will quantity to a formidable 20.4 TWh, equivalent to a proportion electrical energy surplus of 58%.

Ethiopia is among the world’s fastest-growing economies and is about to see a surge in electrical energy demand, necessitating the enlargement of its hydropower infrastructure. Nonetheless, the non-modular nature of hydropower crops typically results in overbuilt capability, leading to surplus technology till demand catches up.

The pliability inherent in bitcoin mining makes it the proper match for Ethiopia’s surplus electrical energy, providing a method to monetize till residential, business, and industrial consumption catches up. As soon as demand will increase, miners can adapt by relocating or contributing to the financing of recent energy crops.

With out Bitcoin mining, Ethiopia faces the prospect of great electrical energy wastage till demand aligns. By seizing the chance to leverage its considerable vitality sources, Ethiopia positions itself for sustained financial development, with initiatives like Bitcoin mining serving as a catalyst for optimizing useful resource utilization and driving prosperity.

Bitcoin mining will increase Ethiopia’s exports and entry to overseas forex

Ethiopia grapples with a frightening problem: a staggering commerce deficit. With extra {dollars} flowing out than in, the nation faces mounting difficulties in importing very important items and providers. Compounded by a struggling forex, mockingly named the Birr, Ethiopia’s residents are susceptible to hovering inflation charges.

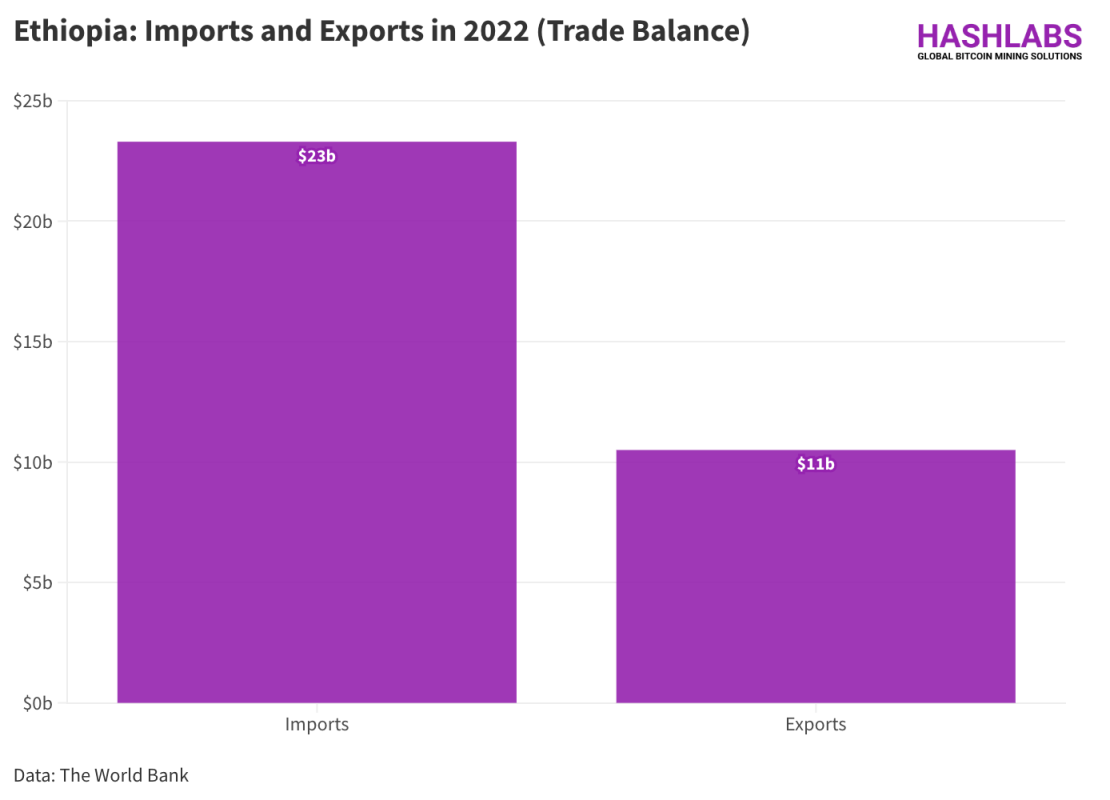

In 2022, Ethiopia imported $23 billion price of services whereas exporting simply $11 billion, leaving a cavernous commerce deficit of $12 billion. This deficit is straining the nation’s potential to satisfy debt obligations, showcased by the continuing negotiations with the Worldwide Financial Fund (IMF) for a possible bailout.

Fortunately, Ethiopia’s considerable electrical energy surplus presents a promising alternative for overseas forex technology via exports. Nonetheless, conventional avenues like promoting electrical energy to neighboring nations have been restricted as a consequence of low demand and weak economies within the area, yielding modest returns of round $70 million yearly.

Enter Bitcoin mining, a revolutionary resolution that transcends geographical constraints by permitting electrical energy to be transformed instantly into digital forex. With minimal funding in transmission infrastructure, Ethiopia can faucet into the worldwide Bitcoin community as a profitable client of its surplus vitality.

By embracing Bitcoin mining, Ethiopia diversifies its export revenue and reduces reliance on neighboring nations for electrical energy gross sales. With the flexibility to export electrical energy via the Web, the nation features a stronger negotiating place and may demand larger costs for its exported energy.

In a latest interview with Bloomberg, Yodahe A. Zemichael of the Info Community Safety Administration (INSA) highlighted the federal government’s motivation of legalizing the bitcoin mining business, citing that corporations pay in overseas forex for the electrical energy they eat in information heart operations.

Contemplating the official bitcoin mining tariff of $0.0314/kWh, Ethiopia stands to generate a considerable export revenue of $640 million if it sells all its extra electrical energy to Bitcoin miners. Moreover, by self-mining with probably the most environment friendly machines obtainable, the nation might probably yield an export revenue of $3.9 billion, making Bitcoin mining a transformative power in Ethiopia’s economic system and probably its largest export business. This tantalizing prospect underscores the transformative potential of Bitcoin mining for Ethiopia’s financial panorama.

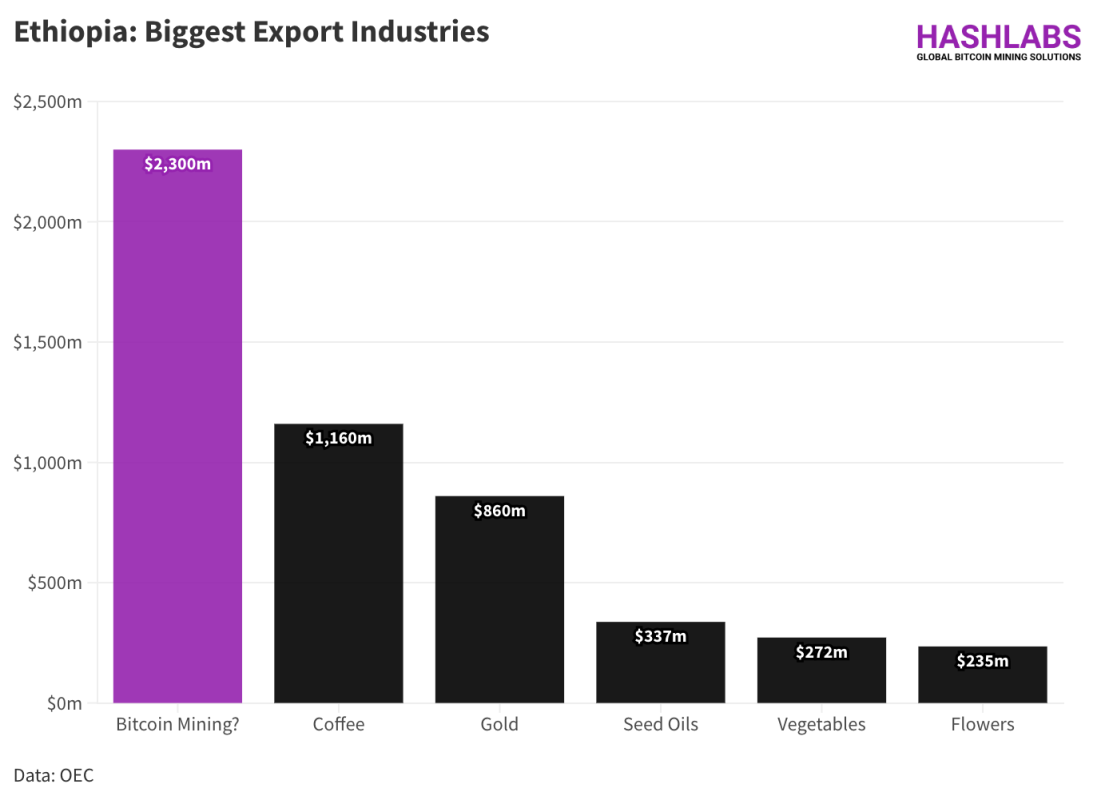

Certainly, it is prudent to regulate our expectations to account for real-world elements such because the Bitcoin halving and Ethiopia’s probably utilization of a portion of its electrical energy surplus for different functions. A extra lifelike estimate of Ethiopia’s export revenue from Bitcoin mining would probably fall someplace between $640 million and $3.9 billion, settling within the center at round $2.3 billion.This determine nonetheless positions Bitcoin mining as the biggest export business in Ethiopia, representing a major financial alternative for the nation.

A $2.3 billion enhance in export revenue would certainly wield transformative energy for the Ethiopian economic system, offering an important injection of overseas forex to strengthen the nationwide forex and facilitate simpler entry to important imports. Furthermore, lowering dependency on overseas lenders would improve Ethiopia’s sovereignty and bolster its financial resilience.

At this pivotal second, Ethiopia faces the crucial of addressing its commerce imbalance and charting a course for financial prosperity. Embracing bitcoin mining as a method to export surplus electrical energy via the web presents a groundbreaking alternative to unlock Ethiopia’s financial potential.

Certainly, it might symbolize the best financial alternative of this technology for the nation.

Bitcoin miners can construct out electrical infrastructure in Ethiopia

The problem of electrification in Ethiopia is stark: solely 54% of the inhabitants at present has entry to electrical energy, with rural areas considerably lagging behind city facilities. Whereas cities boast a 94% electrification fee, rural areas battle at simply 43%. The Ethiopian Authorities has set an formidable purpose of reaching near-universal electrification by 2030, however this endeavor faces important hurdles.

The electrification problem in Ethiopia, notably in rural areas, underscores the pressing want for revolutionary options. Whereas the nation boasts important electrical energy technology capability, the principle hurdle lies in transmitting and distributing this vitality to distant communities.

Bitcoin miners supply a possible resolution by financing and setting up substations in rural areas with surplus electrical energy, similar to these close to The Grand Ethiopian Renaissance Dam. These substations might serve not solely miners but additionally close by residents, probably offering electrical energy to total cities.

This strategy, akin to efforts by Gridless in Kenya, might complement Ethiopia’s purpose of near-universal electrification by 2030. Not like in Kenya, the place Gridless focuses on constructing energy crops with bitcoin mining as an anchor buyer, Ethiopia already has enough energy crops. Thus, Ethiopian miners might concentrate on constructing out substations to enhance the inhabitants’s entry to electrical energy.

Furthermore, the elevated income from promoting electrical energy to miners might allow Ethiopia to spend money on new electrical infrastructure, together with substations, transmission traces, and distribution networks. Consequently, bitcoin miners might not directly finance the enlargement {of electrical} infrastructure in Ethiopia, contributing to electrification for Ethiopians and fostering socio-economic growth nationwide.

Bitcoin mining brings tech jobs to Ethiopia

Ethiopia, boasting the second-largest inhabitants in Africa with 122 million inhabitants, predominantly contains a youthful demographic. Regrettably, the nation faces a major problem of excessive unemployment charges amongst its youth.

Introducing the bitcoin mining business might probably present avenues for accessing tech jobs, not restricted to mining amenities but additionally encompassing the broader bitcoin economic system poised to develop alongside the foundational development of the bitcoin mining business.

Bitcoin mining will convey a major quantity of jobs to Ethiopians throughout many abilities and expertise. On this, Advisor at Hashlabs Mining Ethiopia, Kal Kassa says:

“500 jobs per bitcoin miner is a excessive purpose to satisfy and I doubt this rumor we’ve been listening to is an sincere reflection of the federal government’s intent to manage and add thresholds to funding. That being mentioned, amenities with funding over $100 million are very prone to require greater than 500 personnel, contractors, distributors, and native suppliers. Actually, we see greater than double that in curiosity from technicians and electrical engineers. Coaching and certifying expert expertise shall be a pillar of our targets in Ethiopia and I’ve little doubt we are going to encourage a technology ahead.”

Moreover, Hashlabs Mining has sponsored the onboarding of a whole bunch of wallets at ALX Ethiopia, DevFest’24, and the Info Community Safety Administration (INSA) consistent with this imaginative and prescient.

Kassa continues, “For programmers and devs constructing, I urge them to construct a profile and open a free lightning pockets with sost.tech and related initiatives to receives a commission in bitcoin. BTrust Builders can also be a strong vacation spot for knowledgeable laptop engineers and fans. Hashlabs Mining Ethiopia, and numerous extra sponsors, shall be supporting these instructional and vocational efforts through the funded Hashlabs Training Fund and BitcoinBirr.”

BitcoinBirr, a group of educators and innovators, boasts a powerful imaginative and prescient for offering bitcoin studying supplies throughout a number of languages and areas. Telegram is the most well-liked platform for communication amongst its mods and members. Most lately Kal Kassa gave a presentation titled “Mining Bitcoin of the Nile River” at Bitcoin Oasis in Dubai. Within the subsequent few weeks, and with sponsors from the world over, BitcoinBirr want to full the bitcoin coaching of all 2,000 workers at INSA, along with different establishments and organizations which have requested bitcoin schooling.

Past hackathons and displays, Hashlabs Mining is dedicated to the coaching of expertise in tech. Non-public sector leaders like Mehrteab Leul and Associates (MLA), Yingke Consultants, Grant Thornton Advisory, MMCY Tech, Boseti Power Exploration, Meedo Information, HabeshaView, Flawless Occasions, Training Issues Addis, Tryst Cafe, Ethiopian Airways and Sheraton Addis are extremely appreciated and we honor your friendship throughout our work in Ethiopia.

Ethiopia can leverage mining to construct a bitcoin treasury

The Ethiopian Funding Holdings (EIH), the nation’s sovereign wealth fund, has been rumored to associate with a Chinese language bitcoin and information mining group. As per a LinkedIn submit shared by EIH’s official account, we perceive the undertaking will include a multi-million greenback funding.

Given the pure sequence of occasions that happen with bitcoin miners, the buildup of bitcoin could also be a means for Ethiopia’s treasury to keep up a stability of BTC on behalf of its nation. As strategies for collateral and proof of reserves develop throughout the bitcoin “house”, these reserves could also be used to show creditworthiness.

The occasions surrounding Change Traded Funds (ETFs) and the Securities and Change Fee (SEC) can also be instructive to Ethiopians.

There may be additionally a sentiment from some Bitcoiners that governments shouldn’t be concerned in bitcoin mining. And that bitcoin is an experiment by cryptopunks and libertarians to create instruments for the free market. Given Ethiopia’s latest communist historical past from 1974 to 1991, Ethiopia’s residents and leaders might have a refresher course on the Austrian College of Economics.

Conclusion

We’re witnessing important growth in actual time. It’s tough to level in direction of a singular occasion or catalyst. However we’re on the heart of a really critical and attention-grabbing second in our historical past. The second we’re experiencing permits worth to be generated from an open and free group of bitcoin miners. And this novel expertise permits humanity to protect worth throughout time and house.

As we dive into the long run, it might even be essential to notice the necessity for humility. It needs to be remembered that over the previous few years, Ethiopians and East Africa have witnessed a haunting quantity of demise and destruction, typically self-inflicted and lots of occasions manipulated on the world stage.

We will’t convey again our fallen associates. Like our pricey brother Tekeste Sebhat Nega, an early bitcoiner and a visionary. He misplaced his life in the previous few weeks of 2020. An lively and sensible younger man died in a mindless civil conflict. And there are various extra tales like him. The whole nation goes via a syndrome of kinds, so let’s stay humble as we feature the burden.

Let’s transfer with goal, ardour, and dignity towards a future that values math and physics greater than fiat and violence. That’s our hope for ourselves and that’s the vitality with which we are going to function in Ethiopia.

It is a visitor submit by Jaran Mellerud & Kal Kassa. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.